![]()

- Bitcoin, the cryptocurrency, went ballistic, jumping over 50% in a week and reaching another all-time high of $16,000. Bitcoin is on track to clock in a YTD gain of over 1,500%.

- Prime Minister May has managed to achieve a ‘Brexit Breakthrough’ striking a deal with the EU to unlock divorce negotiations, opening the way for post-Brexit future talks.

- US President Donald Trump announced that the US will recognize Jerusalem as the capital of Israel, sparking clashes on the Israel-Palestinian border.

- Shares of Steinhoff International Holdings, owner of UK’s Poundland, plunged over 90% on Friday morning trading as the global retailer is plagued by an accounting scandal threatening its survival.

![]()

![]()

- Tuesday 12 December will see the release of UK Inflation data with consensus expectations of 3.0%.

- On Wednesday, December 13, the US Federal Open Market Committee (FOMC) is expected to raise the target Fed Fund rate by 0.25% taking it up to 1.5%.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/11/17

Notice:

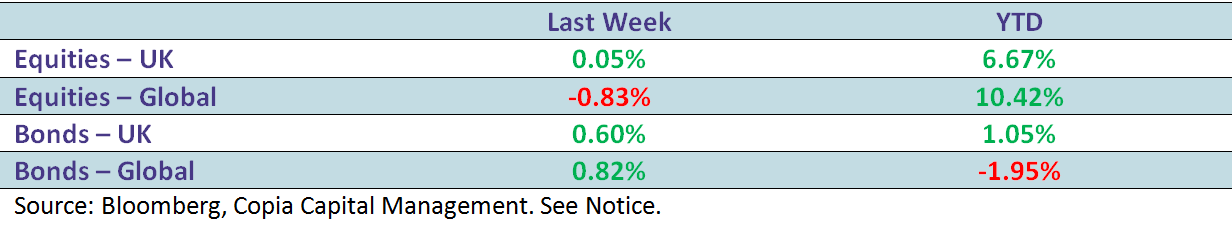

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.