![]()

![]() On Sunday May 10, Boris Johnson said that the coronavirus had past its peak in the UK and announced a conditional plan to reopen the economy, encouraging people to return to their worksite if their jobs cannot be done remotely but recommending those who can to stay working at home. The shops and primary schools were estimated to open in June at earliest, depending on the UK Covid Alert System.

On Sunday May 10, Boris Johnson said that the coronavirus had past its peak in the UK and announced a conditional plan to reopen the economy, encouraging people to return to their worksite if their jobs cannot be done remotely but recommending those who can to stay working at home. The shops and primary schools were estimated to open in June at earliest, depending on the UK Covid Alert System.

![]() Jerome Powell said on Wednesday May 13 that the US Fed is not considering negative rates while additional policy measures may be needed as the economic damage of coronavirus is unprecedented and the outlook is highly uncertain.

Jerome Powell said on Wednesday May 13 that the US Fed is not considering negative rates while additional policy measures may be needed as the economic damage of coronavirus is unprecedented and the outlook is highly uncertain.

![]() UK GDP released on Wednesday shows that the UK economy contracted by 2.2% in the first quarter of 2020 compared to the same quarter last year, with services and construction industries seeing record drops. The Eurozone GDP decreased by 3.2%YoY in the first quarter of 2020, marking the sharpest decline since 1995.

UK GDP released on Wednesday shows that the UK economy contracted by 2.2% in the first quarter of 2020 compared to the same quarter last year, with services and construction industries seeing record drops. The Eurozone GDP decreased by 3.2%YoY in the first quarter of 2020, marking the sharpest decline since 1995.

![]() According to the Global Times report on Friday May 15, China is looking to make an unreliable entity list in order to suspend US companies in China including Apple, Boeing and Cisco. The reporting was following the announcement by the US Bureau of Industry and Security on Friday, which aims to ban Huawei from buying US tech products.

According to the Global Times report on Friday May 15, China is looking to make an unreliable entity list in order to suspend US companies in China including Apple, Boeing and Cisco. The reporting was following the announcement by the US Bureau of Industry and Security on Friday, which aims to ban Huawei from buying US tech products.

![]()

![]()

![]() UK CPI will be announced on Wednesday, May 20, with an expectation of 1.5% YoY.

UK CPI will be announced on Wednesday, May 20, with an expectation of 1.5% YoY.

![]() UK Markit Services PMI for May will be released on Thursday May 21, expected at 22.10.

UK Markit Services PMI for May will be released on Thursday May 21, expected at 22.10.

![]()

-0.74*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/04/19

Notice:

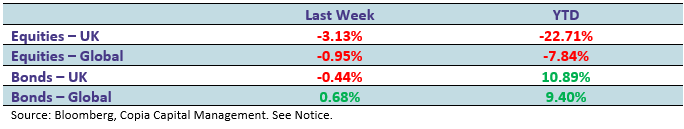

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.