![]()

![]() The US-China trade tensions were reignited after Trump accused China of hiding the information about Coronavirus and threatened that the US would impose new tariffs on Chinese imports as the ultimate punishment on Monday May 4.

The US-China trade tensions were reignited after Trump accused China of hiding the information about Coronavirus and threatened that the US would impose new tariffs on Chinese imports as the ultimate punishment on Monday May 4.

![]() On Thursday May 6, BoE announced that the interest rates will be kept unchanged at 0.1% and the bond purchasing will be maintained at £635 billion. The bank also noted that the UK GDP is expected to fall by 14% in 2020 and indicated another expansion on bond buying in June meeting.

On Thursday May 6, BoE announced that the interest rates will be kept unchanged at 0.1% and the bond purchasing will be maintained at £635 billion. The bank also noted that the UK GDP is expected to fall by 14% in 2020 and indicated another expansion on bond buying in June meeting.

![]() On Tuesday May 5, the UK coronavirus recorded death toll climbed by 693 to 29,427 and became the second highest in the world. Boris Johnson suggested on Wednesday that he intends to ease some lockdown measures from Monday May 11.

On Tuesday May 5, the UK coronavirus recorded death toll climbed by 693 to 29,427 and became the second highest in the world. Boris Johnson suggested on Wednesday that he intends to ease some lockdown measures from Monday May 11.

![]() On Thursday, Telefonica, the parent company of O2, announced its mobile carrier O2 will merge with Liberty Global’s cable operator Virgin Media. The merger deal is valued at £31.4 billion.

On Thursday, Telefonica, the parent company of O2, announced its mobile carrier O2 will merge with Liberty Global’s cable operator Virgin Media. The merger deal is valued at £31.4 billion.

![]()

![]()

![]() China CPI will be announced on Tuesday May 12, with an expectation of 4.8% YoY.

China CPI will be announced on Tuesday May 12, with an expectation of 4.8% YoY.

![]() US CPI will be announced on the same day, Tuesday May 12, with an expectation of 0.8% YoY.

US CPI will be announced on the same day, Tuesday May 12, with an expectation of 0.8% YoY.

![]()

-0.74*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/04/20

Notice:

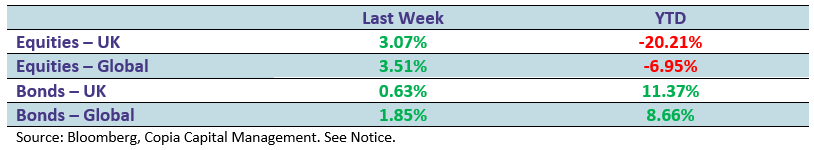

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.