![]()

![]() Last week, JPMorgan, Goldman Sachs and Morgan Stanley released earnings reports for Q1. JPMorgan reported its revenue at $28.3 billion, 3% lower compared to the same period last year and the earnings per share plunged 71% YoY to $0.78. Compared to the Q1 2019, Goldman Sachs’ EPS dropped 45% to $3.11 and total revenue decreased by 1.1% to $8.7 billion. Morgan Stanley also reported a drop in revenue by 7.8% YoY to $9.49 billion and EPS was down by 27% YoY, standing at $1.01.

Last week, JPMorgan, Goldman Sachs and Morgan Stanley released earnings reports for Q1. JPMorgan reported its revenue at $28.3 billion, 3% lower compared to the same period last year and the earnings per share plunged 71% YoY to $0.78. Compared to the Q1 2019, Goldman Sachs’ EPS dropped 45% to $3.11 and total revenue decreased by 1.1% to $8.7 billion. Morgan Stanley also reported a drop in revenue by 7.8% YoY to $9.49 billion and EPS was down by 27% YoY, standing at $1.01.

![]() Following the OPEC+ deal last week to cut their combined oil production by 10 million barrels per day from May 1, on Thursday April 16, Russia agreed to join other OPEC+ nations to implement the cuts over the next two years and stated that OPEC+ will take further measures if the target cuts fail to stabilise the oil market. Even with the production cuts being announced, crude oil has continued to fall making a new 20 year low of $18/barrel for WTI.

Following the OPEC+ deal last week to cut their combined oil production by 10 million barrels per day from May 1, on Thursday April 16, Russia agreed to join other OPEC+ nations to implement the cuts over the next two years and stated that OPEC+ will take further measures if the target cuts fail to stabilise the oil market. Even with the production cuts being announced, crude oil has continued to fall making a new 20 year low of $18/barrel for WTI.

![]() On Thursday, Trump announced three-phase guidelines to reopen the US economy from the lockdown. In phase one, employees will be still advised to minimise the non-essential travel while this will be allowed in phase two. In the final phase, non-essential travel will be unrestricted and employees can resume working on site.

On Thursday, Trump announced three-phase guidelines to reopen the US economy from the lockdown. In phase one, employees will be still advised to minimise the non-essential travel while this will be allowed in phase two. In the final phase, non-essential travel will be unrestricted and employees can resume working on site.

![]() China GDP for Q1 2020 was published on Friday April 17, which slipped 6.8% YoY, missing the market estimates and marking the first contraction since 1992.

China GDP for Q1 2020 was published on Friday April 17, which slipped 6.8% YoY, missing the market estimates and marking the first contraction since 1992.

![]()

![]()

![]() UK unemployment rate will be released on Tuesday April 21, expected at 3.8%.

UK unemployment rate will be released on Tuesday April 21, expected at 3.8%.

![]() UK CPI for March will be announced on Wednesday April 22, with an expectation of 1.7% YoY.

UK CPI for March will be announced on Wednesday April 22, with an expectation of 1.7% YoY.

![]()

+0.19*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/03/20

Notice:

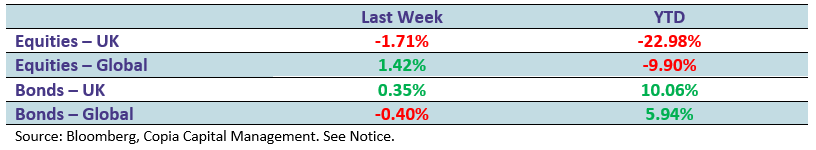

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.