![]()

![]() On Monday April 6, Boris Johnson was taken to intensive care unit as his coronavirus symptoms worsened. Meanwhile, the daily death toll from coronavirus surged to 936 in UK on Thursday, the highest level of daily growth. Globally, the confirmed coronavirus cases surpassed 1.5 million on Wednesday April 8.

On Monday April 6, Boris Johnson was taken to intensive care unit as his coronavirus symptoms worsened. Meanwhile, the daily death toll from coronavirus surged to 936 in UK on Thursday, the highest level of daily growth. Globally, the confirmed coronavirus cases surpassed 1.5 million on Wednesday April 8.

![]() On Wednesday, the US Democratic Party presidential candidate Bernie Sanders ended his presidential campaign, which means that Joe Biden will face President Donald Trump in general election in November.

On Wednesday, the US Democratic Party presidential candidate Bernie Sanders ended his presidential campaign, which means that Joe Biden will face President Donald Trump in general election in November.

![]() The UK GDP growth in three months to February was announced last week, showing a moderate growth at 0.1%, positively contributed by services sector only. The US initial jobless claims published on Thursday showed another addition of 6.6 million to the first-time unemployment in the week ending April 4.

The UK GDP growth in three months to February was announced last week, showing a moderate growth at 0.1%, positively contributed by services sector only. The US initial jobless claims published on Thursday showed another addition of 6.6 million to the first-time unemployment in the week ending April 4.

![]() On Thursday, the US Fed announced a new loan programme which will provide $2.3 trillion for US small and medium-sized businesses and local governments, aiming to stabilise the US economy during the period of constrained economic activity.

On Thursday, the US Fed announced a new loan programme which will provide $2.3 trillion for US small and medium-sized businesses and local governments, aiming to stabilise the US economy during the period of constrained economic activity.

![]()

![]()

![]() Eurozone CPI for March will be announced on Friday April 17, with an expectation of 0.7% YoY.

Eurozone CPI for March will be announced on Friday April 17, with an expectation of 0.7% YoY.

![]() Also on Friday April 17, China GDP growth for Q1 2020 will be released, at an expected rate of -6.0% YoY.

Also on Friday April 17, China GDP growth for Q1 2020 will be released, at an expected rate of -6.0% YoY.

![]()

+0.19*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/03/2020

Notice:

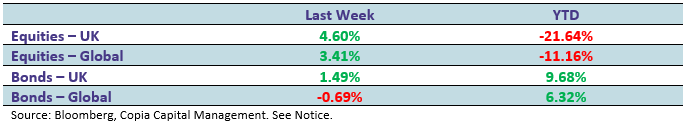

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.