![]()

![]() While coronavirus has been generally contained in China, a surge in new cases emerged in the rest of the world. Italy was put into lockdown as the infected cases jumped to over 15,000 and the death toll passed 1,000 in the country.

While coronavirus has been generally contained in China, a surge in new cases emerged in the rest of the world. Italy was put into lockdown as the infected cases jumped to over 15,000 and the death toll passed 1,000 in the country.

![]() With coronavirus fears spreading, the sell-off in Asian, European and US equity markets continued during last week. Trading halts were triggered on Monday March 9 and Thursday March 12 in the US market as Dow Jones dropped over 7% in a single day. Major European indexes saw a one-day drop nearly or more than 10% on Thursday.

With coronavirus fears spreading, the sell-off in Asian, European and US equity markets continued during last week. Trading halts were triggered on Monday March 9 and Thursday March 12 in the US market as Dow Jones dropped over 7% in a single day. Major European indexes saw a one-day drop nearly or more than 10% on Thursday.

![]() Central Banks announced different stimulus to mitigate the economic impact of coronavirus. On Wednesday March 11, BoE cut interest rate by 50bps from 0.75% to 0.25%. On Thursday, ECB decided to keep the current interest rate unchanged at 0.00% while adding extra asset purchases of €120 billion until the end of the year. The US Fed launched a liquidity package in total of $1.5 trillion on Thursday for the following month.

Central Banks announced different stimulus to mitigate the economic impact of coronavirus. On Wednesday March 11, BoE cut interest rate by 50bps from 0.75% to 0.25%. On Thursday, ECB decided to keep the current interest rate unchanged at 0.00% while adding extra asset purchases of €120 billion until the end of the year. The US Fed launched a liquidity package in total of $1.5 trillion on Thursday for the following month.

![]() The oil price war between Saudi Arabia and Russia escalated with Saudi Aramco promising on Wednesday to increase oil production to 13 million barrels per day from 9.7 million barrels per day next month.

The oil price war between Saudi Arabia and Russia escalated with Saudi Aramco promising on Wednesday to increase oil production to 13 million barrels per day from 9.7 million barrels per day next month.

![]()

![]()

![]() UK will reveal the unemployment rate for three months ending in February on Tuesday March 17, which is expected at 3.8%.

UK will reveal the unemployment rate for three months ending in February on Tuesday March 17, which is expected at 3.8%.

![]() Bank of Japan will announce interest rates decision on Thursday March 19, which is expected to remain unchanged at -0.10%.

Bank of Japan will announce interest rates decision on Thursday March 19, which is expected to remain unchanged at -0.10%.

![]()

+0.69*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/02/20

Notice:

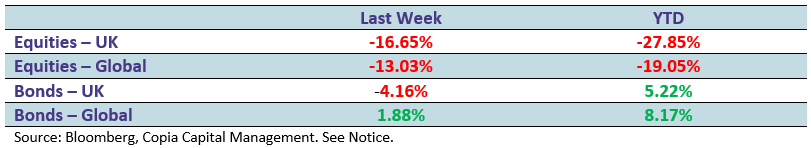

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.