![]()

![]() Over last week, the coronavirus infections have been mounting outside China. The number of infections was rising fast in South Korea, Japan, Italy and Iran, with confirmed cases jumping to 2,337, 935, 655 and 388 respectively. Around the world, the total number of the infected climbed to 83,906, causing 2,869 deaths as of Friday February 28.

Over last week, the coronavirus infections have been mounting outside China. The number of infections was rising fast in South Korea, Japan, Italy and Iran, with confirmed cases jumping to 2,337, 935, 655 and 388 respectively. Around the world, the total number of the infected climbed to 83,906, causing 2,869 deaths as of Friday February 28.

![]() A sell-off in Asian, European and US equity markets was triggered by worries over coronavirus last week. US stocks dropped sharply on Thursday February 27 as the Dow Jones plunged by 4.42%, making the biggest fall in history, together with the S&P 500 and Nasdaq, which also experienced steep losses of more than 4% in one day.

A sell-off in Asian, European and US equity markets was triggered by worries over coronavirus last week. US stocks dropped sharply on Thursday February 27 as the Dow Jones plunged by 4.42%, making the biggest fall in history, together with the S&P 500 and Nasdaq, which also experienced steep losses of more than 4% in one day.

![]() Also on Thursday, the UK government published the Brexit negotiating mandate for talks with EU, which says that the UK will not abide by the European Union regulations, including the European Court of Justice and it aims to finalise a deal with EU by September.

Also on Thursday, the UK government published the Brexit negotiating mandate for talks with EU, which says that the UK will not abide by the European Union regulations, including the European Court of Justice and it aims to finalise a deal with EU by September.

![]() On Friday February 28, the European Commission approved the share purchase deal of Saudi Aramco acquiring 70% stake in Saudi Basic Industries Corporation for $69 billion.

On Friday February 28, the European Commission approved the share purchase deal of Saudi Aramco acquiring 70% stake in Saudi Basic Industries Corporation for $69 billion.

![]()

![]()

![]() On Monday March 2, China Manufacturing PMI will also be released and is expected to come in at 45.7.

On Monday March 2, China Manufacturing PMI will also be released and is expected to come in at 45.7.

![]() US Non-farm payroll employment data will be released on Friday March 6, with an expectation of 176,000 new jobs created for the month of February.

US Non-farm payroll employment data will be released on Friday March 6, with an expectation of 176,000 new jobs created for the month of February.

![]()

+0.69*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/02/2020

Notice:

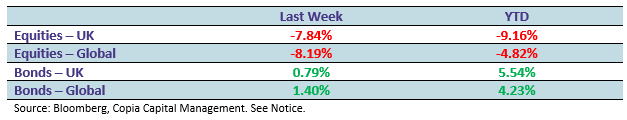

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.