![]()

- Bitcoin, the cryptocurrency, hit an all-time high of $10,000 for the first time, posting a YTD gain of 900%.

- The US tax bill continues to be closely watched by investors around the world, while the White House weighs on replacing Secretary of State Rex Tillerson as his relationship with the President sours.

- North Korea tested its new ICBM (InterContinental Ballistic Missile) on November 29, claiming it had a range to reach Washington D.C.

- The engagement of Prince Harry to TV star Meghan Markle overshadowed news of the UK agreeing to potentially pay a Brexit divorce bill of £50 Bn to the EU. The UK is now a step closer to securing a Brexit deal with the EU.

- President Trump and Prime Minister May had a war of words after the US President tweeted on anti-Muslim videos posted by Britain First, a far-Right group.

![]()

![]()

- On Friday 8 December we will have the release of UK Industrial Production, with expectations of a drop of 0.01% MoM.

- Friday 8 December will also see the release of US Non-Farm Payroll data with an expectation of 210K jobs and the unemployment rate expected to come in at 4.1%.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/11/17

Notice:

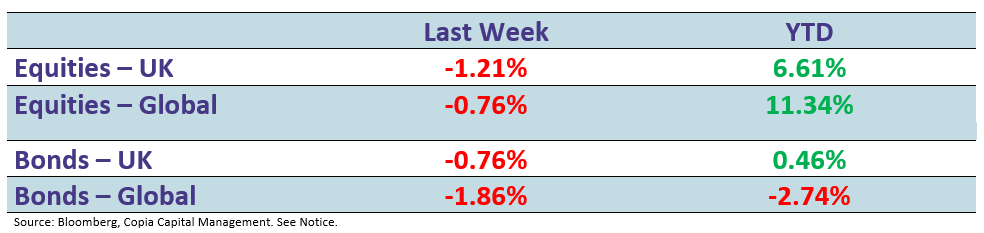

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.