![]()

![]() China Changed the counting method of infection number of coronavirus again last week, which rose to 75,465 as of February 21 and the death toll increased to 2,236 in China. In Korea and Japan, the confirmed infections surged to 204 and 740 respectively over last week.

China Changed the counting method of infection number of coronavirus again last week, which rose to 75,465 as of February 21 and the death toll increased to 2,236 in China. In Korea and Japan, the confirmed infections surged to 204 and 740 respectively over last week.

![]() On Tuesday February 18, HSBC announced a potential cut on its global workforce by 15% or 35,000 jobs after the company’s profit declined by 32.9% in 2019. The bank revealed on Thursday February 20 that it will move to invest more in the retail and private banking business.

On Tuesday February 18, HSBC announced a potential cut on its global workforce by 15% or 35,000 jobs after the company’s profit declined by 32.9% in 2019. The bank revealed on Thursday February 20 that it will move to invest more in the retail and private banking business.

![]() On Wednesday February 19, the US fed published the minutes of the January meeting. The policymakers agreed that the current monetary policy is appropriate and will keep the interest rates unchanged for a while.

On Wednesday February 19, the US fed published the minutes of the January meeting. The policymakers agreed that the current monetary policy is appropriate and will keep the interest rates unchanged for a while.

![]() According to the Federal Election Commission (FEC), the founder and majority owner of Bloomberg LP, Michael Bloomberg, who is now an US Democratic presidential candidate, has spent $220 million on his presidential campaign in January and $409 million since the launch of the campaign in November 2019.

According to the Federal Election Commission (FEC), the founder and majority owner of Bloomberg LP, Michael Bloomberg, who is now an US Democratic presidential candidate, has spent $220 million on his presidential campaign in January and $409 million since the launch of the campaign in November 2019.

![]()

![]()

![]() US GDP growth for Q4 2019 will be released on Thursday February 27, at an expected annualised growth rate of 2.1% QoQ.

US GDP growth for Q4 2019 will be released on Thursday February 27, at an expected annualised growth rate of 2.1% QoQ.

![]() Japan unemployment rate will also be revealed on Thursday February 27 and is expected at 2.2%.

Japan unemployment rate will also be revealed on Thursday February 27 and is expected at 2.2%.

![]()

+0.67*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 15/02/2020

Notice:

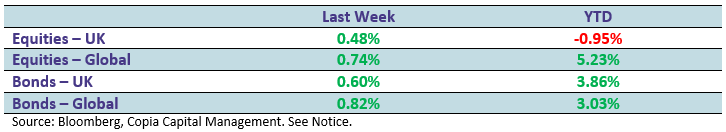

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.