![]()

![]() US tech giant Google joined the exclusive $1 Trillion valuation club as the stock price surged over $1,450 per share. There are now 5 companies in the world with over $1 Trillion in market capitalisation.

US tech giant Google joined the exclusive $1 Trillion valuation club as the stock price surged over $1,450 per share. There are now 5 companies in the world with over $1 Trillion in market capitalisation.

![]() After more than 2 years of trade war talks, the much awaited about phase 1 trade deal between US and China was signed on January 15, as per schedule. Markets welcomed the trade tariff truce as US stocks hit new record highs.

After more than 2 years of trade war talks, the much awaited about phase 1 trade deal between US and China was signed on January 15, as per schedule. Markets welcomed the trade tariff truce as US stocks hit new record highs.

![]() UK retail sales fell sharply in December as the Christmas shopping spree failed to materialise. As economic slowdown worries grow, bond traders are expecting the Bank of England to cut rates by 25 bps in the upcoming BOE meeting on January 30.

UK retail sales fell sharply in December as the Christmas shopping spree failed to materialise. As economic slowdown worries grow, bond traders are expecting the Bank of England to cut rates by 25 bps in the upcoming BOE meeting on January 30.

![]() China reported its GDP numbers last week showing a growth of 6%, consistent with market expectations and within the 6% – 6.5% official government target.

China reported its GDP numbers last week showing a growth of 6%, consistent with market expectations and within the 6% – 6.5% official government target.

![]()

![]()

![]() UK Manufacturing PMI will be reporting on Friday, January 24 and is expected to come in at 48.8 indicating a contraction of UK manufacturing.

UK Manufacturing PMI will be reporting on Friday, January 24 and is expected to come in at 48.8 indicating a contraction of UK manufacturing.

![]() On Friday, January 24, US Manufacturing PMI will also be reported and is expected to come in at 52.6 indicating an expansion of US manufacturing sector.

On Friday, January 24, US Manufacturing PMI will also be reported and is expected to come in at 52.6 indicating an expansion of US manufacturing sector.

![]()

+0.65*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/12/19

Notice:

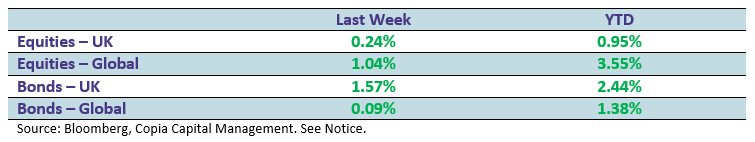

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.