![]()

![]() On Tuesday December 31, Trump announced that the phase one trade deal which had been agreed with China earlier in December will be signed on January 15 and he will visit China at a later date for phase two deal negotiations.

On Tuesday December 31, Trump announced that the phase one trade deal which had been agreed with China earlier in December will be signed on January 15 and he will visit China at a later date for phase two deal negotiations.

![]() Also on Tuesday, former Nissan Chairman Carlos Ghosn, who is accused of financial misconduct, escaped from house arrest in Tokyo by hiding in a music instrument box and fled from Japan to Lebanon on a private jet.

Also on Tuesday, former Nissan Chairman Carlos Ghosn, who is accused of financial misconduct, escaped from house arrest in Tokyo by hiding in a music instrument box and fled from Japan to Lebanon on a private jet.

![]() On Wednesday January 1, the People’s Bank of China (PBOC) decided to cut banks’ reserve requirement ratio by 50bps, taking effect from January 8, which will release approximately 800 billion Chinese yuan to the market.

On Wednesday January 1, the People’s Bank of China (PBOC) decided to cut banks’ reserve requirement ratio by 50bps, taking effect from January 8, which will release approximately 800 billion Chinese yuan to the market.

![]() On Friday January 3, the US confirmed that Iranian Major General Qassem Soleimani was killed in rocket attacks on Baghdad airport by the US military. According to the Pentagon, the action was taken in order to protect US personnel abroad.

On Friday January 3, the US confirmed that Iranian Major General Qassem Soleimani was killed in rocket attacks on Baghdad airport by the US military. According to the Pentagon, the action was taken in order to protect US personnel abroad.

![]()

![]()

![]() Eurozone CPI for December will be announced on Monday January 6, with an expectation of 1.3% YoY.

Eurozone CPI for December will be announced on Monday January 6, with an expectation of 1.3% YoY.

![]() US Non-farm payroll employment data will be released on Friday January 10, with an expectation of 160,000 new jobs created for the month of December.

US Non-farm payroll employment data will be released on Friday January 10, with an expectation of 160,000 new jobs created for the month of December.

![]()

+0.65*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/12/19

Notice:

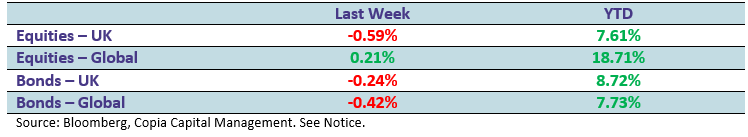

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.