![]()

![]() On Tuesday December 17, Peugeot manufacturer PSA Group and Fiat Chrysler Automobiles signed a merger deal that is worth $50 billion. The combination will make the world’s third-largest car manufacturer by revenue.

On Tuesday December 17, Peugeot manufacturer PSA Group and Fiat Chrysler Automobiles signed a merger deal that is worth $50 billion. The combination will make the world’s third-largest car manufacturer by revenue.

![]() On Wednesday December 18, the UK government published the amended Withdrawal Agreement Bill with a new clause added that rules out any extension to the post-Brexit transition period.

On Wednesday December 18, the UK government published the amended Withdrawal Agreement Bill with a new clause added that rules out any extension to the post-Brexit transition period.

![]() On Thursday December 19, the US House of Representatives voted in favour of impeaching President Donald Trump, accusing him of abusing his power and obstructing Congress. However, the impeachment did not point to a criminal offense.

On Thursday December 19, the US House of Representatives voted in favour of impeaching President Donald Trump, accusing him of abusing his power and obstructing Congress. However, the impeachment did not point to a criminal offense.

![]() Also on Thursday, the Bank of England decided to keep the current interest rated unchanged at 0.75% and noted that UK GDP growth was projected to pick up from current below-potential rates due to less Brexit uncertainties, a loose fiscal policy and a modest recovery in global economic growth.

Also on Thursday, the Bank of England decided to keep the current interest rated unchanged at 0.75% and noted that UK GDP growth was projected to pick up from current below-potential rates due to less Brexit uncertainties, a loose fiscal policy and a modest recovery in global economic growth.

![]()

![]()

![]() On Monday December 23, Singapore CPI for November will also be released, with an expectation of 0.6 YoY.

On Monday December 23, Singapore CPI for November will also be released, with an expectation of 0.6 YoY.

![]() Canada GDP growth will also be released on Monday December 23, at an expected rate of 1.4% YoY.

Canada GDP growth will also be released on Monday December 23, at an expected rate of 1.4% YoY.

![]()

+0.56*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/11/19

Notice:

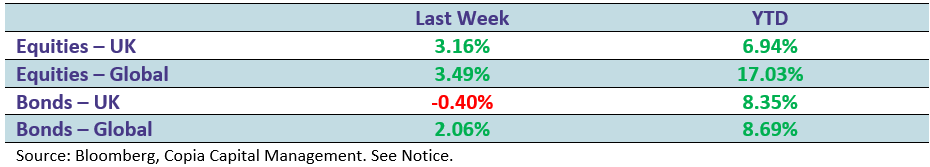

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.