![]()

![]() On Wednesday December 11, the US Fed unanimously voted to hold interest rates at their present levels. The target range for the federal funds rates will stay at 1.5% -1.75% to support the sustained but moderate economic expansion.

On Wednesday December 11, the US Fed unanimously voted to hold interest rates at their present levels. The target range for the federal funds rates will stay at 1.5% -1.75% to support the sustained but moderate economic expansion.

![]() On Thursday December 12, the European Central Bank kept its interest rate unchanged at 0% and expressed that they do not expect it to increase until Eurozone inflation moves sufficiently close to, but below 2%.

On Thursday December 12, the European Central Bank kept its interest rate unchanged at 0% and expressed that they do not expect it to increase until Eurozone inflation moves sufficiently close to, but below 2%.

![]() On Thursday December 12, Trump signed off the Phase One trade deal with China. As a part of trade deal, the US offered to reduce the existing tariffs on Chinese goods and cancel the new tariffs which were set to kick in on December 15. Meanwhile China agreed to purchase $50 billion worth of agricultural products from the US in 2020.

On Thursday December 12, Trump signed off the Phase One trade deal with China. As a part of trade deal, the US offered to reduce the existing tariffs on Chinese goods and cancel the new tariffs which were set to kick in on December 15. Meanwhile China agreed to purchase $50 billion worth of agricultural products from the US in 2020.

![]() On Friday December 13, the British Conservatives won the general election after securing 365 seats in Parliament. Following the results, leader of the Liberal Democrats Jo Swinson and Labour head Jeremy Corbyn announced that they will step down as party leaders.

On Friday December 13, the British Conservatives won the general election after securing 365 seats in Parliament. Following the results, leader of the Liberal Democrats Jo Swinson and Labour head Jeremy Corbyn announced that they will step down as party leaders.

![]()

![]()

![]() On Wednesday December 18, UK CPI for November will also be released, with an expectation of 1.4% YoY.

On Wednesday December 18, UK CPI for November will also be released, with an expectation of 1.4% YoY.

![]() US GDP growth will be released on Friday December 20, at an expected annualised growth rate of 2.1% QoQ.

US GDP growth will be released on Friday December 20, at an expected annualised growth rate of 2.1% QoQ.

![]()

+0.56*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/11/19

Notice:

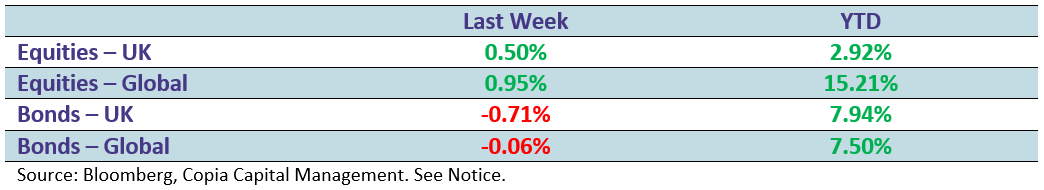

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.