![]()

![]() Last week, the November Caixin PMI for China’s services sector was released, which jumped to seven-month high of 53.5, picking up from a slow expansion in past few months amid the economic slowdown. The Caixin Manufacturing PMI published earlier was also showing an unexpected fast expansion of China’s manufacturing sector in November.

Last week, the November Caixin PMI for China’s services sector was released, which jumped to seven-month high of 53.5, picking up from a slow expansion in past few months amid the economic slowdown. The Caixin Manufacturing PMI published earlier was also showing an unexpected fast expansion of China’s manufacturing sector in November.

![]() On Wednesday December 5, Japanese Prime Minister Shinzo Abe announced that a fiscal stimulus package of $120B will be approved by Japanese government to keep the economy stable.

On Wednesday December 5, Japanese Prime Minister Shinzo Abe announced that a fiscal stimulus package of $120B will be approved by Japanese government to keep the economy stable.

![]() Also on Wednesday, the OPEC members agreed on an extension on oil output cut by additional 500,000 barrels per day in the first quarter of 2020 due to the declining demand in crude oil market.

Also on Wednesday, the OPEC members agreed on an extension on oil output cut by additional 500,000 barrels per day in the first quarter of 2020 due to the declining demand in crude oil market.

![]() The France biggest nationwide strike in decades started on Thursday December 6. The strike was against Macron’s pension reform announced in June, planning to raise the retiring age for public sector employees.

The France biggest nationwide strike in decades started on Thursday December 6. The strike was against Macron’s pension reform announced in June, planning to raise the retiring age for public sector employees.

![]()

![]()

![]() China CPI for November will be announced on Tuesday December 10, with an expectation of 4.4% YoY.

China CPI for November will be announced on Tuesday December 10, with an expectation of 4.4% YoY.

![]() On Wednesday December 11, US CPI for November will also be released, with an expectation of 2.0% YoY.

On Wednesday December 11, US CPI for November will also be released, with an expectation of 2.0% YoY.

![]()

+0.56*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/11/19

Notice:

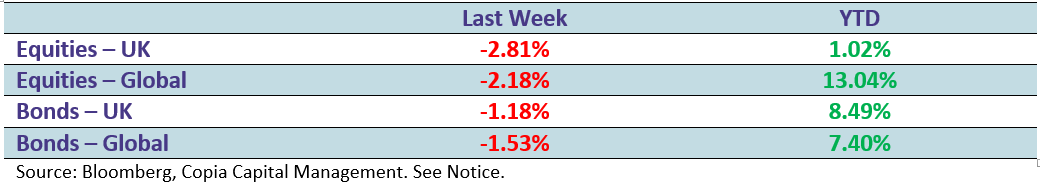

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.