![]() UK manufacturing activity has risen at the fastest rate in three decades in May with business sentiment climbing to its highest level since 2012.

UK manufacturing activity has risen at the fastest rate in three decades in May with business sentiment climbing to its highest level since 2012.

![]() UK house price growth increased by 10.9% in May according to the national house price index. The average house price is now £242,832, an increase of £23,930 over the last twelve months.

UK house price growth increased by 10.9% in May according to the national house price index. The average house price is now £242,832, an increase of £23,930 over the last twelve months.

![]() Eurozone inflation expanded to a greater than expected 2% in May according to Eurostat’s preliminary report.

Eurozone inflation expanded to a greater than expected 2% in May according to Eurostat’s preliminary report.

![]() US President Biden on Friday has released his $6 trillion budget with a surge in spending on infrastructure and social spending.

US President Biden on Friday has released his $6 trillion budget with a surge in spending on infrastructure and social spending.

![]() French Budget to be announced on Wednesday June 2.

French Budget to be announced on Wednesday June 2.

![]() UK 10 year bond auction to take place on Wednesday June 2.

UK 10 year bond auction to take place on Wednesday June 2.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/05/21

Notice:

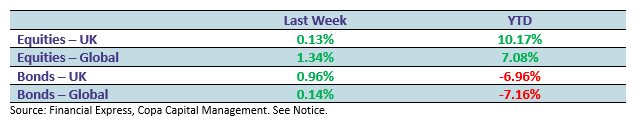

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.