The infoshot to help kick-start your week

Last Week

- Shanghai launched a two-stage lockdown of its 26 million residents, closing bridges and tunnels, and restricting highway traffic in an attempt to contain surging COVID-19 cases.

- U.S. President Joe Biden plans to release up to 1 million barrels of oil a day for six months from the Strategic Petroleum Reserve in a new effort to drive down oil prices. Consequently, U.S. oil prices fell 7%, just above $100 on Thursday.

- The S&P500 ended the first quarter down by almost 5%, Dow Jones Industrial Average down 4.6% and the Nasdaq composite index down 9.1%.

- Inflation in the eurozone hit its highest level of 7.5%.

- The U.S. labour market tightened again in March with the jobless rate falling to a new post-pandemic low. Nonfarm payrolls rose by 431,000 in the month through mid-March and the unemployment rate fell to 3.6% from 3.8% in February.

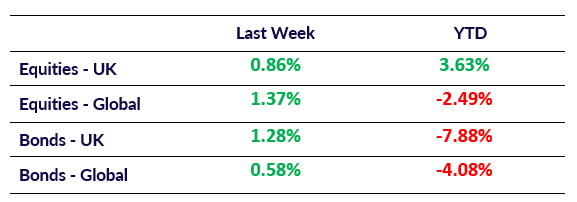

Market Pulse

Coming Up

- UK Construction PMI to be released on 6th April.

- US FOMC minutes released on 6th April.

- UK Halifax House Price Index MoM to be released on 7th April.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel