The infoshot to help kick-start your week

Last Week

- The U.S. and UK reached a deal to ease tariffs on British steel and aluminium, resolving a longstanding complication as the nation’s work together to strengthen trade and integration.

- Rishi Sunak has announced a 5p a litre cut to fuel duty.

- Russia’s stocks jumped on the first day of trading in almost a month.

- The UK imposed fresh sanctions on several Russian businesses and individuals on Thursday. The latest companies to be sanctioned include Moscow-based Alfa-Bank; diamond miner Alrosa; defence drone maker Kronshtadt; and controversial mercenary provider the Wagner Group.

- The Bank of England said it was considering delaying plans to tighten its capital requirements for banks among economic concerns caused by Russia’s invasion of Ukraine.

- The United States will work to supply 15 billion cubic metres of liquefied natural gas to the European Union this year to help wean it off Russian gas supplies. The EU is aiming to cut its dependency on Russian gas by two-thirds this year and end all Russian fossil fuel imports by 2027.

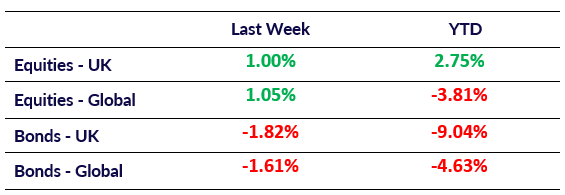

Market Pulse

Coming Up

- U.S. Nonfarm Payrolls to be released on the 1st of April, forecasted to be 475K.

- UK GDP (YoY) to be released on 31st of March, forecasted to be 6.5%.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel