The infoshot to help kick-start your week

Last Week

- The Santa Claus rally appears to have retained momentum with the S&P 500 hitting a record high on Tuesday and the FTSE 100 a 22-month high on Wednesday

- On Friday the 31st the FTSE 100 opened down 0.4% but had its best year-to-date performance since 2016 of just over 14%

- The US Department of Labour released figures confirming that initial jobless claims were below the expectations of 208,000, at 198,000, in the week leading up to the 25th of December

- In the UK, Nationwide released their latest survey that revealed that house prices were up 10.4% year-on-year, having their strongest year since 2006

- Market sentiment appears more positive compared to the beginning of the month as investors seem to be focusing on the lower than expected hospitalisation rates from the Omicron varian

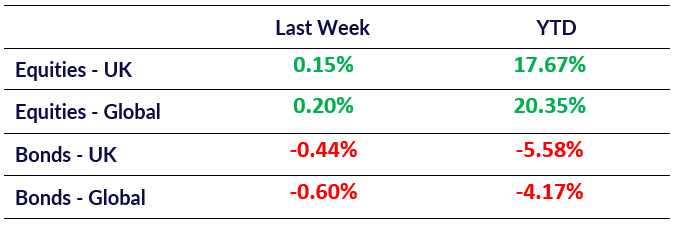

Market Pulse

Coming Up

- US Nonfarm Payrolls for December released on January 7th, Consensus of 400K

- US Unemployment Rate for December released on January 7th, Consensus of 4.1%

- Euro zone Retail Sales released on January 7th, Consensus of -0.5%

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel