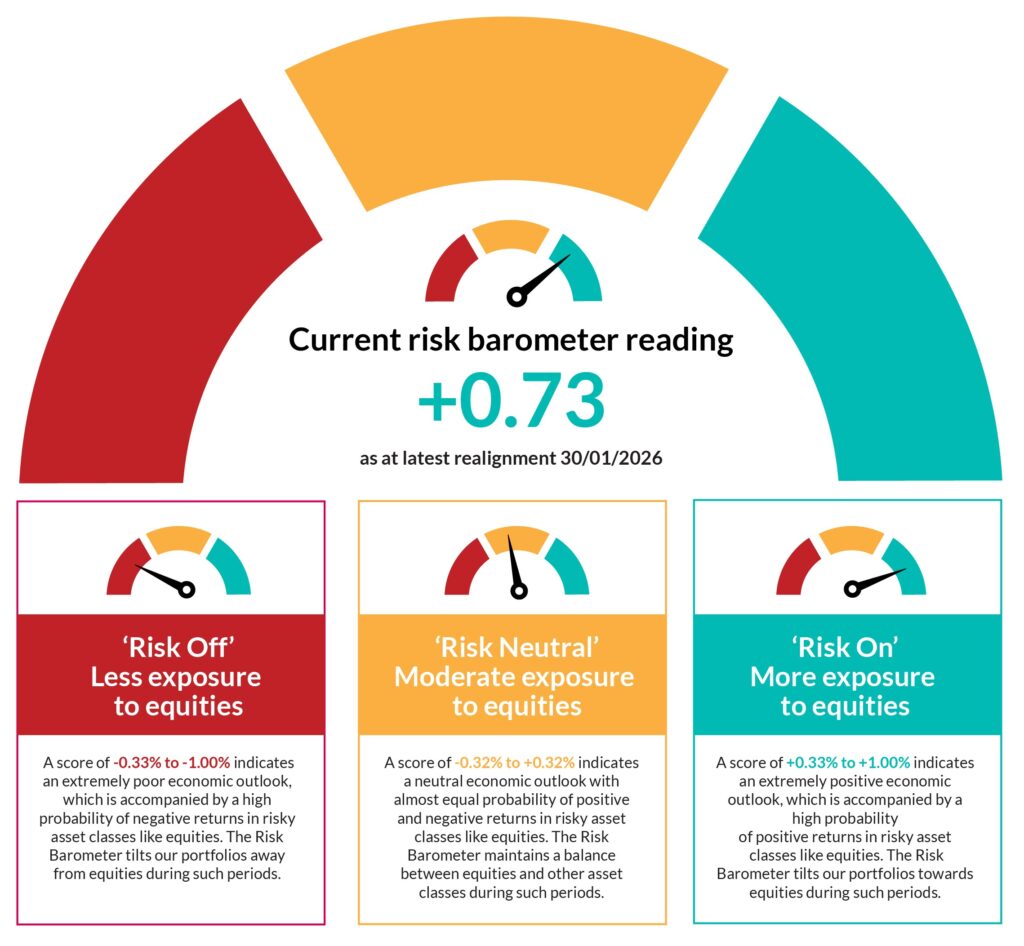

Every successful investment partnership is grounded in data and based on a mutual appreciation of risk. Copia’s highly successful and scientific investment methodology is guided by our specially developed, proprietary Risk Barometer.

This unique tool is available only to Copia’s clients. It takes the predictive output from our Quant model ensuring that all tactical asset allocation decisions are driven by a sound quantitative process, reducing manager risk and behavioural biases.

We use the Risk Barometer to help you manage investment uncertainty for your clients. Our Quant Model looks at economic indicators and current investment prices to predict the future economic outlook. The Risk Barometer adds an additional layer of protection for clients, tilting portfolios towards safer asset classes during periods of uncertainty to further reduce client exposure to riskier investments.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.

This information is intended for professional financial advisers only. Copia does not provide financial advice. This information is not intended as financial advice and should not be interpreted as such. Model investment portfolios may not be suitable for everyone. The value of funds can increase and decrease, past performance and historical data cannot guarantee future success. Investors may get back less than they originally invested.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

I work for an advisory / professional firm or other eligible counterparty.

I will take responsibility for any jurisdictional restrictions that apply to the services described by this website in accordance with applicable law and regulation.

I have read and accept that Cookies are used on this website. I understand that a Cookie will show that I have accepted the terms to access this website.

I confirm that I am resident in the UK or other EU Country and I am not a US citizen.

I have read and accept that Cookies are used on this website. I understand that a Cookie will show that I have accepted the terms to access this website.

The content of this website may only be viewed by persons that meet either of the above conditions. If neither option is applicable please click here which will close this webpage.

Error: Contact form not found.