![]() The U.S. equity rally continued last week with both the S&P 500 and Dow Jones hitting new all time high benchmarks on Thursday on the back of strong earnings and employment data.

The U.S. equity rally continued last week with both the S&P 500 and Dow Jones hitting new all time high benchmarks on Thursday on the back of strong earnings and employment data.

![]() The number of initial jobless claims in the United States for the week ending August 7th declined by 12,000 when compared to the figure from the previous week.

The number of initial jobless claims in the United States for the week ending August 7th declined by 12,000 when compared to the figure from the previous week.

![]() A Covid-19 outbreak amongst the workers of the Ningbo-Zhoushan port in China has seen a partial shutdown of one of the world’s busiest shipping ports, possibly increasing supply constraints that are impacting business across the globe.

A Covid-19 outbreak amongst the workers of the Ningbo-Zhoushan port in China has seen a partial shutdown of one of the world’s busiest shipping ports, possibly increasing supply constraints that are impacting business across the globe.

![]() The U.K GDP has surged forward by 4.8% in the months between April and June of this year. The second highest quarterly growth rate seen since the 1970s.

The U.K GDP has surged forward by 4.8% in the months between April and June of this year. The second highest quarterly growth rate seen since the 1970s.

![]() U.K consumer price index data to be released on Wednesday August 18th, expected 2.0% YoY.

U.K consumer price index data to be released on Wednesday August 18th, expected 2.0% YoY.

![]() U.K average earnings index data to be released on Tuesday August 17th, expected increase of 7.1% YoY.

U.K average earnings index data to be released on Tuesday August 17th, expected increase of 7.1% YoY.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/07/21

Notice:

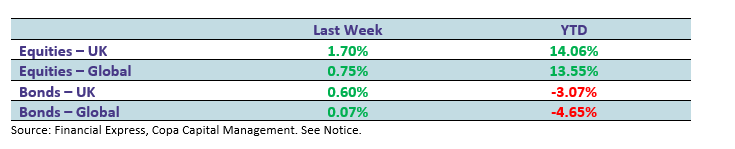

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.