![]() The European Central Bank announced on Thursday to keep key interest rates at current levels along with keeping its asset purchase program unchanged. Further supporting the Eurozone economy as it emerges from lockdown.

The European Central Bank announced on Thursday to keep key interest rates at current levels along with keeping its asset purchase program unchanged. Further supporting the Eurozone economy as it emerges from lockdown.

![]() US inflation reached 5% YoY in May, nearing a 13 year high on the back of a reopening of the US economy and supply chains which are now re-adjusting to meet renewed demand.

US inflation reached 5% YoY in May, nearing a 13 year high on the back of a reopening of the US economy and supply chains which are now re-adjusting to meet renewed demand.

![]() UK GDP grew 2.3% in April according to preliminary data released on Friday by the Office for National Statistics. Further confirming the positive growth outlook reflected in UK equity markets.

UK GDP grew 2.3% in April according to preliminary data released on Friday by the Office for National Statistics. Further confirming the positive growth outlook reflected in UK equity markets.

![]() Oil prices dipped on Friday but headed for its third weekly rise following increased recovery in fuel demand in Europe, China and the United States.

Oil prices dipped on Friday but headed for its third weekly rise following increased recovery in fuel demand in Europe, China and the United States.

![]() UK CPI data to be released on Wednesday June 16. Expected 1.80% YoY.

UK CPI data to be released on Wednesday June 16. Expected 1.80% YoY.

![]() Eurozone CPI data to be released on Thursday June 17. Expected 2.00% YoY.

Eurozone CPI data to be released on Thursday June 17. Expected 2.00% YoY.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/05/21

Notice:

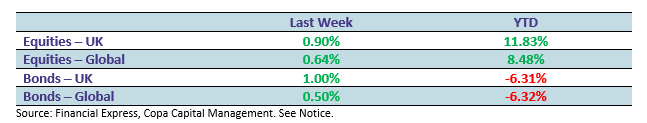

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.