![]() On Thursday May 6, the BoE made interest rates decision to keep the benchmark Bank Rate unchanged at 0.1%, and maintaining the bond purchasing programme at £895bn as expected. However, the central bank changed to a more hawkish tone, adjusting the UK growth forecast to 7.25% for 2021 from previous 5% and said the pace of gilt purchase could slow down.

On Thursday May 6, the BoE made interest rates decision to keep the benchmark Bank Rate unchanged at 0.1%, and maintaining the bond purchasing programme at £895bn as expected. However, the central bank changed to a more hawkish tone, adjusting the UK growth forecast to 7.25% for 2021 from previous 5% and said the pace of gilt purchase could slow down.

![]() On Thursday, China announced its decision to indefinitely suspend the China-Australia Strategic Economic Dialogue as Australia cancelled two signed deals under China’s Belt and Road Initiative earlier in April.

On Thursday, China announced its decision to indefinitely suspend the China-Australia Strategic Economic Dialogue as Australia cancelled two signed deals under China’s Belt and Road Initiative earlier in April.

![]() US nonfarm payrolls data was published on Friday May 7, showing an employment increase of 260k in April, below the estimates of 1mn. The US unemployment rate increased by 0.1% in April compared to March, standing at 6.1%.

US nonfarm payrolls data was published on Friday May 7, showing an employment increase of 260k in April, below the estimates of 1mn. The US unemployment rate increased by 0.1% in April compared to March, standing at 6.1%.

![]() The European Commission said on Friday that it is going to sign the deal to buy 1.8 bn doses of vaccines from Pfizer and BioNTech to fasten the pace of vaccination. The EU is expected to have its 70% of the adult population to be vaccinated by the mid-July.

The European Commission said on Friday that it is going to sign the deal to buy 1.8 bn doses of vaccines from Pfizer and BioNTech to fasten the pace of vaccination. The EU is expected to have its 70% of the adult population to be vaccinated by the mid-July.

![]() China CPI for April will be announced on Tuesday May 11, expected at 1.0% YoY.

China CPI for April will be announced on Tuesday May 11, expected at 1.0% YoY.

![]() US CPI for April will be announced on Wednesday May 12, expected at 3.6% YoY.

US CPI for April will be announced on Wednesday May 12, expected at 3.6% YoY.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/04/21

Notice:

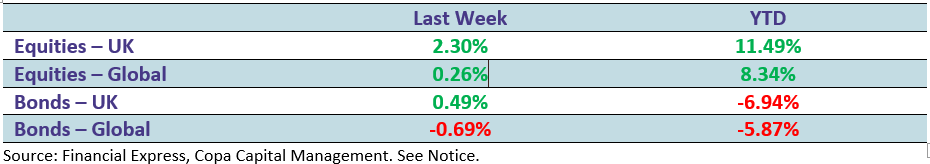

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.