![]()

![]() Bitcoin hit another high last week, moving above $52,000 as Elon Musk defended Tesla’s $1.5 Billion investment in the cryptocurrency.

Bitcoin hit another high last week, moving above $52,000 as Elon Musk defended Tesla’s $1.5 Billion investment in the cryptocurrency.

![]() The US state of Texas plunged into chaos as blackouts swept across the state in the midst of an historic cold blast leaving millions in the dark. The winter storms blanketing the US could cost the country over $50 Billion in economic damage. Oil prices spiked due to a supply squeeze as several US shale drillers paused operations in the Permian basin.

The US state of Texas plunged into chaos as blackouts swept across the state in the midst of an historic cold blast leaving millions in the dark. The winter storms blanketing the US could cost the country over $50 Billion in economic damage. Oil prices spiked due to a supply squeeze as several US shale drillers paused operations in the Permian basin.

![]() Regulators in the US are investigating the Gamestop mania by questioning CEO of Robinhood, the trading app that was primarily used by investors to fuel the buying frenzy. Unfortunately, a large number of retail investors lost money in buying Gamestop shares at its peak of $475/share. Gamestop traded at $42 down 90% from the highs made in late January.

Regulators in the US are investigating the Gamestop mania by questioning CEO of Robinhood, the trading app that was primarily used by investors to fuel the buying frenzy. Unfortunately, a large number of retail investors lost money in buying Gamestop shares at its peak of $475/share. Gamestop traded at $42 down 90% from the highs made in late January.

![]() Bond yields continued to climb on worries that inflation could return strongly if the Biden administration’s manages to pass its $1.9 Trillion relief package proposal.

Bond yields continued to climb on worries that inflation could return strongly if the Biden administration’s manages to pass its $1.9 Trillion relief package proposal.

![]()

![]()

![]() US 4Q GDP data will be announced on Thursday February 25, expected at 4.1% QoQ.

US 4Q GDP data will be announced on Thursday February 25, expected at 4.1% QoQ.

![]() On Wednesday February 24, Eurozone CPI data will be released and is expected to come in at 0.9% YoY.

On Wednesday February 24, Eurozone CPI data will be released and is expected to come in at 0.9% YoY.

![]()

+0.70*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 01/02/21

Notice:

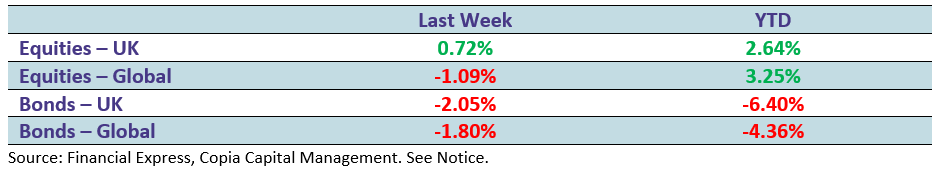

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.