![]()

![]() On Tuesday December 1, US senators proposed a stimulus package worth $908bn to tackle the coronavirus crisis. The package was reported to cover four-month unemployment benefit payments of $300 per week, $240bn of local governments funding, $300bn to finance small businesses as well as $50bn on healthcare including the coronavirus vaccine distribution.

On Tuesday December 1, US senators proposed a stimulus package worth $908bn to tackle the coronavirus crisis. The package was reported to cover four-month unemployment benefit payments of $300 per week, $240bn of local governments funding, $300bn to finance small businesses as well as $50bn on healthcare including the coronavirus vaccine distribution.

![]() On Wednesday December 2, the UK Department of Health and Social Care (DHS) announced the approval of the emergency use of the Covid-19 vaccine developed by Pfizer and BioNTech and secured the roll-out of around 800,000 vaccine doses in the UK by next week.

On Wednesday December 2, the UK Department of Health and Social Care (DHS) announced the approval of the emergency use of the Covid-19 vaccine developed by Pfizer and BioNTech and secured the roll-out of around 800,000 vaccine doses in the UK by next week.

![]() On Thursday December 3, OPEC+ reached an agreement to gradually raise oil output by up to 500k barrels per day over the next three months, starting from next month.

On Thursday December 3, OPEC+ reached an agreement to gradually raise oil output by up to 500k barrels per day over the next three months, starting from next month.

![]() US nonfarm payrolls data was published on Friday December 4, showing an employment increase of 245k in November, below the estimates of 460k. The US unemployment rate decreased by 0.2% in November compared to October, standing at 6.7%.

US nonfarm payrolls data was published on Friday December 4, showing an employment increase of 245k in November, below the estimates of 460k. The US unemployment rate decreased by 0.2% in November compared to October, standing at 6.7%.

![]()

![]()

![]() Japan annualised GDP growth will be released on Monday December 7, at an expected rate of 21.6% QoQ.

Japan annualised GDP growth will be released on Monday December 7, at an expected rate of 21.6% QoQ.

![]() China CPI for November will be announced on Wednesday December 9, with an expectation of 0.0% YoY.

China CPI for November will be announced on Wednesday December 9, with an expectation of 0.0% YoY.

![]()

+0.05*

+0.05*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/11/20

Notice:

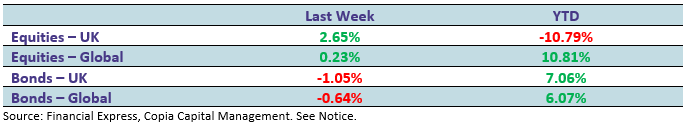

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.