![]()

![]() Several media reported last week that Joe Biden is expected to nominate the former Federal Reserve Chair Janet Yellen to serve as the US Treasury secretary, indicating that the Treasury’s focus is likely to shift towards solving economic inequality and climate change issues.

Several media reported last week that Joe Biden is expected to nominate the former Federal Reserve Chair Janet Yellen to serve as the US Treasury secretary, indicating that the Treasury’s focus is likely to shift towards solving economic inequality and climate change issues.

![]() On Monday November 23, Joe Biden formally started presidential transition after the US General Services Administration acknowledged him as the president-elect. On the same day, Trump tweeted his permission for Biden’s transition.

On Monday November 23, Joe Biden formally started presidential transition after the US General Services Administration acknowledged him as the president-elect. On the same day, Trump tweeted his permission for Biden’s transition.

![]() On Wednesday November 25, UK Chancellor Rishi Sunak announced that the UK government will provide £280 billion this year and another £55 billion next year as the fund to support the economic recovery. He said that the UK economy is forecast to contract 11.3% in 2020 and would not recover to the pre-pandemic level before Q4 2022.

On Wednesday November 25, UK Chancellor Rishi Sunak announced that the UK government will provide £280 billion this year and another £55 billion next year as the fund to support the economic recovery. He said that the UK economy is forecast to contract 11.3% in 2020 and would not recover to the pre-pandemic level before Q4 2022.

![]() ECB October meeting minutes were released on Thursday November 26, noting that Eurozone economic outlook is bumpier than previously projected, and there are risks of a “double-dip recession” for some economies where the lockdowns are likely to continue next year. The central bank is preparing to extend the stimulus package in December.

ECB October meeting minutes were released on Thursday November 26, noting that Eurozone economic outlook is bumpier than previously projected, and there are risks of a “double-dip recession” for some economies where the lockdowns are likely to continue next year. The central bank is preparing to extend the stimulus package in December.

![]()

![]()

![]() On Monday November 30, China NBS Manufacturing PMI will be released and is expected to come in at 51.30.

On Monday November 30, China NBS Manufacturing PMI will be released and is expected to come in at 51.30.

![]() US Non-farm payroll employment data will be released on Friday December 4, with an expectation of 520,000 new jobs created for the month of November.

US Non-farm payroll employment data will be released on Friday December 4, with an expectation of 520,000 new jobs created for the month of November.

![]()

+0.01*

+0.01*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 20/11/20

Notice:

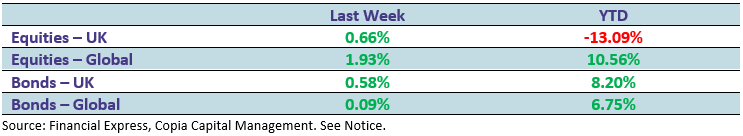

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.