![]()

![]() On Monday August 31, the US 10 Year real Treasury yields measured minus the US implied 10 year inflation rate, dropping to a historical low level at -1.10%, as the inflation expectation has been rising consistently since March.

On Monday August 31, the US 10 Year real Treasury yields measured minus the US implied 10 year inflation rate, dropping to a historical low level at -1.10%, as the inflation expectation has been rising consistently since March.

![]() Last week saw a sharp sell-off of US major tech stocks including Amazon, Facebook, Microsoft, Apple and Alphabet, which had rallied since March whereas now investors are concerned that the expensive valuations of the tech stocks are due for a correction.

Last week saw a sharp sell-off of US major tech stocks including Amazon, Facebook, Microsoft, Apple and Alphabet, which had rallied since March whereas now investors are concerned that the expensive valuations of the tech stocks are due for a correction.

![]() The US nonfarm payroll employment increased by 1.4 million in August, in line with the estimates and the unemployment rate dropped to 8.4% from 10.2% in July.

The US nonfarm payroll employment increased by 1.4 million in August, in line with the estimates and the unemployment rate dropped to 8.4% from 10.2% in July.

![]() On Thursday September 3, the French Prime Minister Jean Castex announced a new stimulus package worth €100 billion to help the country’s economic recovery. According to Castex, €35 billion will be used on the green transition of the economy, €35 billion on tax cuts and other incentives to help businesses, and €35 billion on social and territorial cohesion.

On Thursday September 3, the French Prime Minister Jean Castex announced a new stimulus package worth €100 billion to help the country’s economic recovery. According to Castex, €35 billion will be used on the green transition of the economy, €35 billion on tax cuts and other incentives to help businesses, and €35 billion on social and territorial cohesion.

![]()

![]()

![]() China CPI will be published on Wednesday September 9, with an expectation of 2.4% YoY.

China CPI will be published on Wednesday September 9, with an expectation of 2.4% YoY.

![]() ECB Interest Rate decision will be announced on Thursday September 10, which is expected to be maintained at 0.00%.

ECB Interest Rate decision will be announced on Thursday September 10, which is expected to be maintained at 0.00%.

![]()

-0.40*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/08/20

Notice:

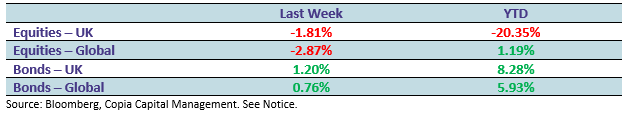

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.