![]()

![]() The US Fed increased its balance sheet by $67.9bn to $7.13 trillion in the week ending Wednesday June 3 and increased its Treasury holdings to $4.13 trillion. The multi-billion bond buying stimulus has lifted inflation expectations with the 30-year Treasury yield hitting 1.75% on Friday June 5.

The US Fed increased its balance sheet by $67.9bn to $7.13 trillion in the week ending Wednesday June 3 and increased its Treasury holdings to $4.13 trillion. The multi-billion bond buying stimulus has lifted inflation expectations with the 30-year Treasury yield hitting 1.75% on Friday June 5.

![]() On Wednesday June 3, Angela Merkel announced a €130bn stimulus package to support Germany economic recovery, including temporary cuts on value-added tax, increased subsidies for electric cars and child bonus for families. Together with the €1.1tn rescue package agreed in March, the programmes are at the size of 30% of the country’s GDP.

On Wednesday June 3, Angela Merkel announced a €130bn stimulus package to support Germany economic recovery, including temporary cuts on value-added tax, increased subsidies for electric cars and child bonus for families. Together with the €1.1tn rescue package agreed in March, the programmes are at the size of 30% of the country’s GDP.

![]() On Thursday June 4, the ECB decided to maintain the benchmark interest rate at 0%, the marginal lending facility and the deposit facility rates at 0.25% and -0.5% respectively. The bank also announced an expansion on its Pandemic Emergency Purchase Programme by €600 billion to €1.35 trillion.

On Thursday June 4, the ECB decided to maintain the benchmark interest rate at 0%, the marginal lending facility and the deposit facility rates at 0.25% and -0.5% respectively. The bank also announced an expansion on its Pandemic Emergency Purchase Programme by €600 billion to €1.35 trillion.

![]() On Friday June 5, US nonfarm payrolls data was published, showing an employment increase of 2.5mn in May, beating the expectation predicting a decrease of 7.5mn. The unemployment rate now stands at 13.3%.

On Friday June 5, US nonfarm payrolls data was published, showing an employment increase of 2.5mn in May, beating the expectation predicting a decrease of 7.5mn. The unemployment rate now stands at 13.3%.

![]()

![]()

![]() Eurozone GDP growth will be released on Tuesday June 9, at an expected rate of -3.20% YoY.

Eurozone GDP growth will be released on Tuesday June 9, at an expected rate of -3.20% YoY.

![]() China CPI will be announced on Wednesday June 10, with an expectation of 2.60% YoY.

China CPI will be announced on Wednesday June 10, with an expectation of 2.60% YoY.

![]()

-0.74*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/05/2020

Notice:

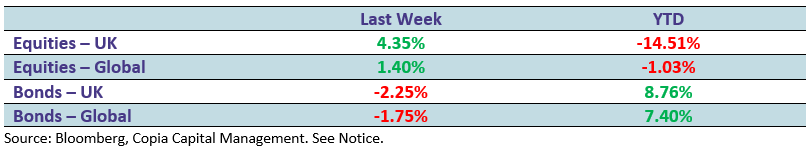

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.