![]()

![]() Former star manager Neil Woodford in a shock announcement on Monday said his flagship fund was suspended for trading as all withdrawals were being blocked as the underlying stocks lacked liquidity to facilitate the withdrawals..

Former star manager Neil Woodford in a shock announcement on Monday said his flagship fund was suspended for trading as all withdrawals were being blocked as the underlying stocks lacked liquidity to facilitate the withdrawals..

![]() On Friday June 7, US Payrolls rose by 75,000 much less than expected signalling a slowing economy and boosting a case for a rate cut from the US Federal Reserve. US 10 Bond Yield touched a 2-year low close to 2% as investors rushed for safe haven assets.

On Friday June 7, US Payrolls rose by 75,000 much less than expected signalling a slowing economy and boosting a case for a rate cut from the US Federal Reserve. US 10 Bond Yield touched a 2-year low close to 2% as investors rushed for safe haven assets.

![]() Equity markets rallied last week recovering from poor returns in May on the back of global central banks increasing stimulus and news that President Trump may delay tariffs against Mexico as US and Mexico resume trade talks.

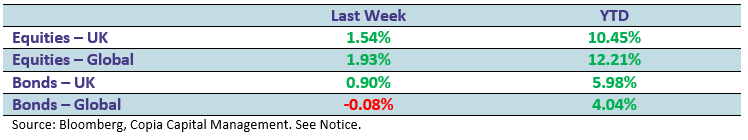

Equity markets rallied last week recovering from poor returns in May on the back of global central banks increasing stimulus and news that President Trump may delay tariffs against Mexico as US and Mexico resume trade talks.

![]() Saudi Arabia expects OPEC+ will extend production cuts into the second half of the 2019. Crude oil bounced back on this news. WTI traded at $53 late Friday afternoon.

Saudi Arabia expects OPEC+ will extend production cuts into the second half of the 2019. Crude oil bounced back on this news. WTI traded at $53 late Friday afternoon.

![]()

![]()

![]() US CPI for May will be announced on Wednesday June 12, with an expectation of 1.9% YoY

US CPI for May will be announced on Wednesday June 12, with an expectation of 1.9% YoY

![]() UK Trade Balance will be released on Monday June 10 expected at deficit £4.7 Billion.

UK Trade Balance will be released on Monday June 10 expected at deficit £4.7 Billion.

![]()

0.56*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/05/19

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.