![]()

![]() On Wednesday 10 April, the ECB decided to keep the current interest rates unchanged as expected. The benchmark interest rate will stay at 0%, the base deposit rate at -0.4%. Mario Draghi, the President of the ECB indicated that Eurozone growth is slower but the risk of recession remains low.

On Wednesday 10 April, the ECB decided to keep the current interest rates unchanged as expected. The benchmark interest rate will stay at 0%, the base deposit rate at -0.4%. Mario Draghi, the President of the ECB indicated that Eurozone growth is slower but the risk of recession remains low.

![]() On Thursday 11 April, EU confirmed an extension of Brexit deadline for the UK to 31 October 2019. However, the EU officials added that the UK will have to participate in the European Parliament election in May, or the extension will be shortened to 1 June.

On Thursday 11 April, EU confirmed an extension of Brexit deadline for the UK to 31 October 2019. However, the EU officials added that the UK will have to participate in the European Parliament election in May, or the extension will be shortened to 1 June.

![]() Uber filed for IPO on Thursday and will list its shares on the New York Stock Exchange, expecting to raise $10bn by selling company’s shares in IPO. Uber’s main competitor Lyft, which went public on 29 March, traded at $87.24 on Nasdaq Exchange.

Uber filed for IPO on Thursday and will list its shares on the New York Stock Exchange, expecting to raise $10bn by selling company’s shares in IPO. Uber’s main competitor Lyft, which went public on 29 March, traded at $87.24 on Nasdaq Exchange.

![]() On Friday 13 April, Chevron announced an agreed deal to acquire Anadarko Petroleum. The total value of the deal is $33bn. The Chairman and CEO of Chevron, Michael Wirth, said that he is anticipating annual run-rate synergies at $2bn after the combination.

On Friday 13 April, Chevron announced an agreed deal to acquire Anadarko Petroleum. The total value of the deal is $33bn. The Chairman and CEO of Chevron, Michael Wirth, said that he is anticipating annual run-rate synergies at $2bn after the combination.

![]()

![]()

![]() The UK CPI will be released on Wednesday 17 April and is expected to come in at 2.0 % YoY.

The UK CPI will be released on Wednesday 17 April and is expected to come in at 2.0 % YoY.

![]() The US trade balance for February will be announced on the same day, Wednesday 17 April, with an expected deficit of $53.4bn.

The US trade balance for February will be announced on the same day, Wednesday 17 April, with an expected deficit of $53.4bn.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/03/19

Notice:

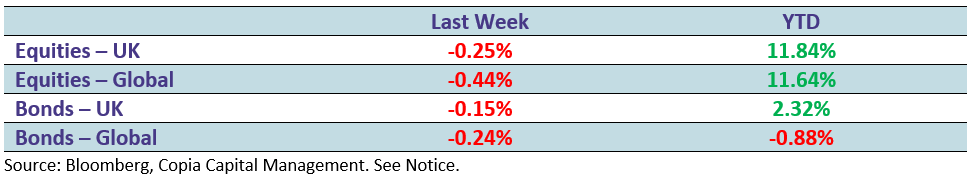

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.