![]()

![]() On Tuesday 12 March, the UK Parliament voted down Theresa May’s Brexit Withdrawal Agreement the second time and on Wednesday 13 March, MPs voted and approved to rule out the possibility of a no-deal Brexit.

On Tuesday 12 March, the UK Parliament voted down Theresa May’s Brexit Withdrawal Agreement the second time and on Wednesday 13 March, MPs voted and approved to rule out the possibility of a no-deal Brexit.

![]() On Thursday 14 March, UK MPs passed the government’s motion to extend the Brexit departure date to be at least 30 June, which however would need approval from all EU member states.

On Thursday 14 March, UK MPs passed the government’s motion to extend the Brexit departure date to be at least 30 June, which however would need approval from all EU member states.

![]() On Friday 15 March, Chinese Premier Li Keqiang announced a VAT cut on manufacturing and other basic sectors, also on small and medium sized companies, starting from 1 April 2019, which is estimated at a scale of 2 trillion CNY (~ US $300 billion).

On Friday 15 March, Chinese Premier Li Keqiang announced a VAT cut on manufacturing and other basic sectors, also on small and medium sized companies, starting from 1 April 2019, which is estimated at a scale of 2 trillion CNY (~ US $300 billion).

![]() Also on Friday, annual inflation rate for Eurozone was published, which stood at 1.5% YoY for February, 0.1% increase compared to its January level of 1.4% YoY.

Also on Friday, annual inflation rate for Eurozone was published, which stood at 1.5% YoY for February, 0.1% increase compared to its January level of 1.4% YoY.

![]()

![]()

![]() UK CPI for February will be released on Wednesday 20 March, which is expected at 1.8% YoY.

UK CPI for February will be released on Wednesday 20 March, which is expected at 1.8% YoY.

![]() Japan CPI for February will be released on Thursday 21 March and is expected to come in at 0.3% YoY.

Japan CPI for February will be released on Thursday 21 March and is expected to come in at 0.3% YoY.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 01/03/2019

Notice:

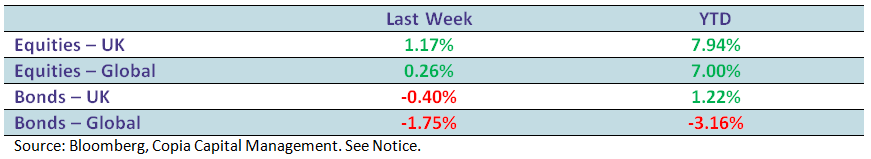

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.