![]()

![]() US midterm elections took place on Tuesday November 6, with Democrats winning control of the House of Representatives and Trump’s Republican Party keeping control of the Senate, creating a potential for a legislative gridlock.

US midterm elections took place on Tuesday November 6, with Democrats winning control of the House of Representatives and Trump’s Republican Party keeping control of the Senate, creating a potential for a legislative gridlock.

![]() On Thursday November 8, the Fed decided to keep the current benchmark interest rate unchanged at 2.25% while the market expects the next rate hike in December, given a strong economic growth and a record low unemployment in the US.

On Thursday November 8, the Fed decided to keep the current benchmark interest rate unchanged at 2.25% while the market expects the next rate hike in December, given a strong economic growth and a record low unemployment in the US.

![]() On Friday November 9, market saw a selloff in Italian government bonds and stocks, largely due to the flat domestic economic growth and European Union officials criticizing the government’s fiscal plans, reinforcing expectations for a budget clash with Brussels.

On Friday November 9, market saw a selloff in Italian government bonds and stocks, largely due to the flat domestic economic growth and European Union officials criticizing the government’s fiscal plans, reinforcing expectations for a budget clash with Brussels.

![]() Oil price (Brent) dropped to the lowest level since April on Friday, on rising concerns of potential oversupply driven increased oil production by Saudi Arabia and Russia and stagnating demand across the world.

Oil price (Brent) dropped to the lowest level since April on Friday, on rising concerns of potential oversupply driven increased oil production by Saudi Arabia and Russia and stagnating demand across the world.

![]()

![]()

![]() US CPI will be released on Wednesday November 14 and is expected to come in at 2.5% YoY.

US CPI will be released on Wednesday November 14 and is expected to come in at 2.5% YoY.

![]() On the same day, Wednesday November 14, UK CPI will also be released, expected to come in at 2.5% YoY.

On the same day, Wednesday November 14, UK CPI will also be released, expected to come in at 2.5% YoY.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/10/18

Notice:

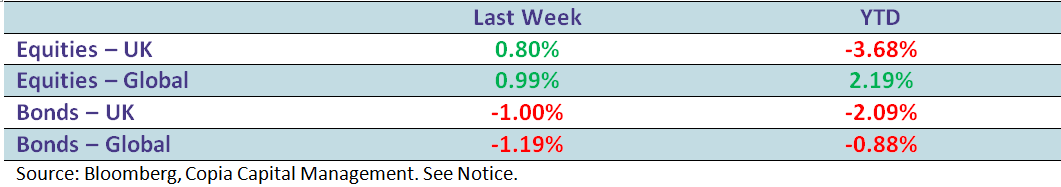

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future