![]()

![]() The additional 25% tariffs levied by the US on $16bn worth of Chinese imports took effect on Thursday.

The additional 25% tariffs levied by the US on $16bn worth of Chinese imports took effect on Thursday.

![]() Fed’s minutes for last meeting in early August was released on Wednesday August 22, suggesting another interest rate hike would be appropriate soon if the economic growth keeps strong and healthy.

Fed’s minutes for last meeting in early August was released on Wednesday August 22, suggesting another interest rate hike would be appropriate soon if the economic growth keeps strong and healthy.

![]() UK published the planning papers for the case of a no-deal Brexit on Thursday August 23, advising pharmaceutical firms to stockpile medicines for a supply of minimum additional six weeks and telling businesses to employ extra customs checks.

UK published the planning papers for the case of a no-deal Brexit on Thursday August 23, advising pharmaceutical firms to stockpile medicines for a supply of minimum additional six weeks and telling businesses to employ extra customs checks.

![]() On Thursday, Alibaba released its quarterly earnings, reporting an increase of 61% YoY in revenue to $12.23bn while its net income and EPS declined by 45% and 42% respectively.

On Thursday, Alibaba released its quarterly earnings, reporting an increase of 61% YoY in revenue to $12.23bn while its net income and EPS declined by 45% and 42% respectively.

![]()

![]()

![]() US GDP growth will be released on Wednesday August 29, at an expected rate of 4.0% annualised growth.

US GDP growth will be released on Wednesday August 29, at an expected rate of 4.0% annualised growth.

![]() The Eurozone CPI will be released on Friday August 31 and is expected to come in at 2.0% YoY.

The Eurozone CPI will be released on Friday August 31 and is expected to come in at 2.0% YoY.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 20/08/18

Notice:

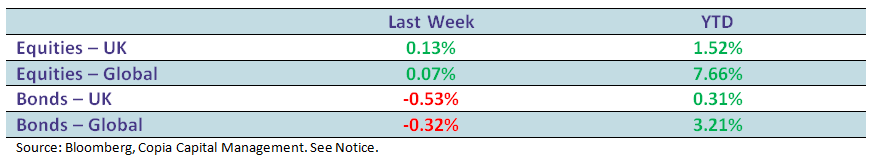

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.