![]()

![]() Microsoft announced its $7.5bn acquisition of a code-sharing site, GitHub, a software development platform used by more than 28 million developers.

Microsoft announced its $7.5bn acquisition of a code-sharing site, GitHub, a software development platform used by more than 28 million developers.

![]() The EU is set to impose a 25% consumer tax on a list of products imported from the US in retaliation for Trump’s decision to tax aluminium and steel imports from the EU.

The EU is set to impose a 25% consumer tax on a list of products imported from the US in retaliation for Trump’s decision to tax aluminium and steel imports from the EU.

![]() With inflation marching towards 5%, the Reserve Bank of India raised the repo rate to 6.25% from 6% on Wednesday. This has not been hiked since 2014.

With inflation marching towards 5%, the Reserve Bank of India raised the repo rate to 6.25% from 6% on Wednesday. This has not been hiked since 2014.

![]() The US and Chinese telecommunication company ZTE reached a deal to lift the ban prohibiting US firms from selling products to ZTE, providing ZTE pay a fine of $1bn and have a US compliance team on the company’s board for monitoring purposes.

The US and Chinese telecommunication company ZTE reached a deal to lift the ban prohibiting US firms from selling products to ZTE, providing ZTE pay a fine of $1bn and have a US compliance team on the company’s board for monitoring purposes.

![]()

![]()

![]() The US CPI for May will be released on Tuesday June 12 and is expected to come in at 2.7% YoY.

The US CPI for May will be released on Tuesday June 12 and is expected to come in at 2.7% YoY.

![]() The UK CPI for May will be released on Wednesday June 13 and is expected to come in at 2.6% YoY.

The UK CPI for May will be released on Wednesday June 13 and is expected to come in at 2.6% YoY.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/05/18

Notice:

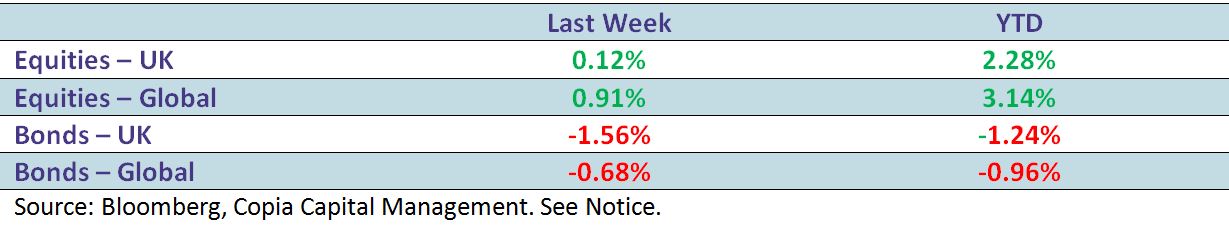

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.