![]()

![]() Facebook reported a strong first-quarter performance in spite of the recent data privacy breach scandal. Daily active users increased 13% YoY to 1.45 billion and revenue increased to $11.966bn, a 49% jump compared to the first quarter last year.

Facebook reported a strong first-quarter performance in spite of the recent data privacy breach scandal. Daily active users increased 13% YoY to 1.45 billion and revenue increased to $11.966bn, a 49% jump compared to the first quarter last year.

![]() Comcast Corp. submitted a $30.7 billion bid for Sky Plc, challenging the offer from Rupert Murdoch’s 21st Century Fox, which owns 39% of Sky’s stake but offered a lower price to purchase the rest of Sky’s shares.

Comcast Corp. submitted a $30.7 billion bid for Sky Plc, challenging the offer from Rupert Murdoch’s 21st Century Fox, which owns 39% of Sky’s stake but offered a lower price to purchase the rest of Sky’s shares.

![]() U.S. 10-year treasury yield reached 3% for the first time in four years on Tuesday.

U.S. 10-year treasury yield reached 3% for the first time in four years on Tuesday.

![]() European Central Bank announced its policy meeting results and decided to leave interest rate unchanged while continuing with the quantitative easing plan to buy 30 billion euros of bonds every month until September.

European Central Bank announced its policy meeting results and decided to leave interest rate unchanged while continuing with the quantitative easing plan to buy 30 billion euros of bonds every month until September.

![]()

![]()

![]() The U.S. will reveal its trade balance for March on Thursday May 3, with an expected deficit of $56.0bn.

The U.S. will reveal its trade balance for March on Thursday May 3, with an expected deficit of $56.0bn.

![]() The U.S. unemployment rate will be released on Friday May 4, and is expected to fall to 4% from 4.1%.

The U.S. unemployment rate will be released on Friday May 4, and is expected to fall to 4% from 4.1%.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 16/04/18

Notice:

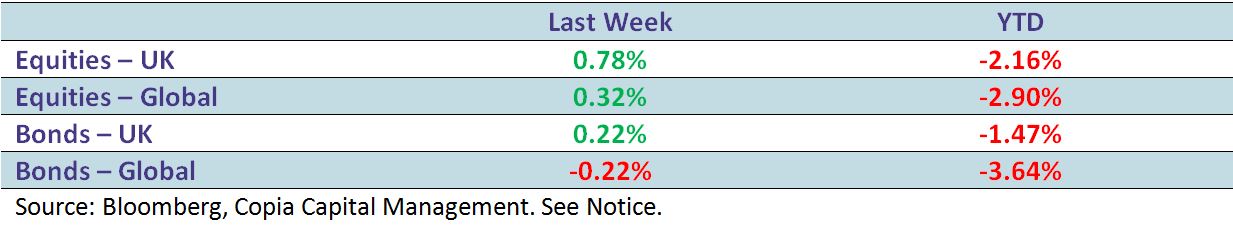

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.