![]()

![]() The U.K. annual wage growth rate increased to 2.8% with the unemployment rate dropping to 4.2% in the three months to February while inflation fell to 2.5% for March, the lowest level in 12 months.

The U.K. annual wage growth rate increased to 2.8% with the unemployment rate dropping to 4.2% in the three months to February while inflation fell to 2.5% for March, the lowest level in 12 months.

![]() The EU proposed a new privacy law that will give law enforcement authorities from its member states the power to access user data held by tech giants such as Google and Facebook. The law will apply to data stored on servers both inside and outside the bloc.

The EU proposed a new privacy law that will give law enforcement authorities from its member states the power to access user data held by tech giants such as Google and Facebook. The law will apply to data stored on servers both inside and outside the bloc.

![]() Morgan Stanley and Goldman Sachs announced their first-quarter reports this week. Morgan Stanley reported a 25% improvement in its sales and trading revenue, while its rival Goldman Sachs delivered a better result with its trading revenue surging by 38%.

Morgan Stanley and Goldman Sachs announced their first-quarter reports this week. Morgan Stanley reported a 25% improvement in its sales and trading revenue, while its rival Goldman Sachs delivered a better result with its trading revenue surging by 38%.

![]()

![]()

![]() U.K. GDP growth will be released on Friday April 27, with an expected rate of 1.5% YoY.

U.K. GDP growth will be released on Friday April 27, with an expected rate of 1.5% YoY.

![]() On the same day, Friday April 27, the U.S. will reveal its GDP annual growth rate, with an expansion rate of 2.1% QoQ expected.

On the same day, Friday April 27, the U.S. will reveal its GDP annual growth rate, with an expansion rate of 2.1% QoQ expected.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 16/04/18

Notice:

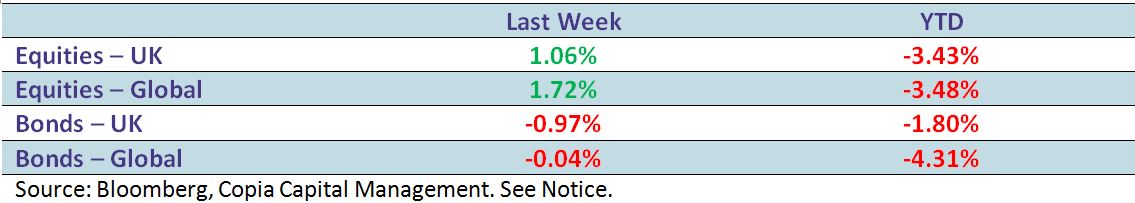

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.