![]()

![]() Theresa May rejected a draft Brexit agreement stating “No Prime Minister could agree to the EU draft Brexit Treaty”. The treaty proposed a common regulatory area that would keep Northern Ireland in the customs union under the single market rules.

Theresa May rejected a draft Brexit agreement stating “No Prime Minister could agree to the EU draft Brexit Treaty”. The treaty proposed a common regulatory area that would keep Northern Ireland in the customs union under the single market rules.

![]() The Communist Party of China proposed to remove the two-term limit for the presidency, enabling president Xi Jinping to remain in power beyond 2023 and indefinitely.

The Communist Party of China proposed to remove the two-term limit for the presidency, enabling president Xi Jinping to remain in power beyond 2023 and indefinitely.

![]() US consumers faced difficulties making credit card repayments. Overdue US credit card debt has reached a seven-year high at $11.9bn at the turn of the year, a rise of 11.5% during the fourth quarter.

US consumers faced difficulties making credit card repayments. Overdue US credit card debt has reached a seven-year high at $11.9bn at the turn of the year, a rise of 11.5% during the fourth quarter.

![]()

![]()

![]() The US trade balance for January will be announced on Wednesday March 7, with an expected decrease in deficit at $52.5bn, from the previous $53.1bn.

The US trade balance for January will be announced on Wednesday March 7, with an expected decrease in deficit at $52.5bn, from the previous $53.1bn.

![]() The US unemployment rate will be released on Friday March 9 and is expected to decrease by 0.1% from 4.1% to 4.0%.

The US unemployment rate will be released on Friday March 9 and is expected to decrease by 0.1% from 4.1% to 4.0%.

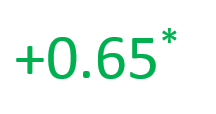

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/02/18

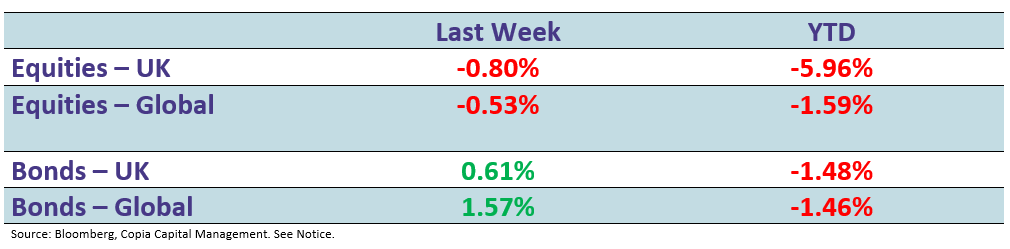

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.