![]()

![]() Global stock markets had a strong start to 2018, reaching record highs with the Dow Jones Industrial Average (DJIA) crossing 25,000 for the first time and Japan’s Nikkei 225 Index hitting a 26-year high.

Global stock markets had a strong start to 2018, reaching record highs with the Dow Jones Industrial Average (DJIA) crossing 25,000 for the first time and Japan’s Nikkei 225 Index hitting a 26-year high.

![]() Best-selling author Michael Wolff’s new book, “Fire and Fury: Inside the Trump White House”, makes disturbing claims about the Trump administration and is reportedly based on over 200 interviews of White House employees. President Trump called the book “full of lies”.

Best-selling author Michael Wolff’s new book, “Fire and Fury: Inside the Trump White House”, makes disturbing claims about the Trump administration and is reportedly based on over 200 interviews of White House employees. President Trump called the book “full of lies”.

![]() HM Treasury has appointed Charles Randell as the chair of the Financial Conduct Authority (FCA), effective from April 1, 2018.

HM Treasury has appointed Charles Randell as the chair of the Financial Conduct Authority (FCA), effective from April 1, 2018.

![]()

![]()

![]() Tuesday 10 January will see the release of UK Industrial Production data with consensus expectations of 1.8% growth YoY.

Tuesday 10 January will see the release of UK Industrial Production data with consensus expectations of 1.8% growth YoY.

![]() On Friday, January 12, US CPI Inflation data will be released. Inflation is expected to come in at 2.1%.

On Friday, January 12, US CPI Inflation data will be released. Inflation is expected to come in at 2.1%.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/12/17

Notice:

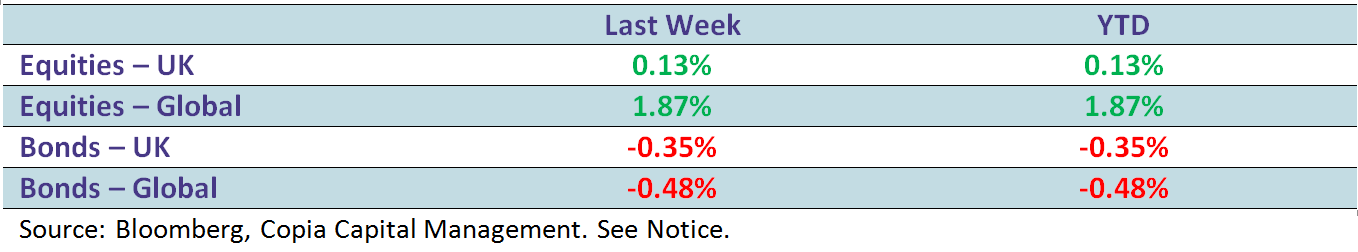

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.