![]()

- At its latest meeting, Mario Draghi, the President of the ECB, somewhat surprised markets by announcing that the ECB will extend its economic stimulus programme until at least September of next year. The Euro (€) fell versus peers on this latest dovish stance

- Japanese Prime Minister Shinzo Abe’s coalition won a resounding victory in Japan’s latest general election. Mr Abe pushed for a shift in Japan’s defence policy, calling for formal recognition of the military within the constitution

- The UK economy grew by 0.4% in the three months from July to September, up from 0.3% in the previous quarter and slightly higher than expected by markets

- The Indian government announced a $32bn plan to recapitalise state controlled banks. This move comes after India’s banking sector was blamed for dragging down economic growth after a decade of unconstrained lending

![]()

![]()

- On Thursday 2 November we will see the much anticipated Bank of England rate decision, with the market pricing in a probability of 89% that there will be a 0.25% rate hike to 0.5%

- On Friday 3 November we will see the release of the latest US Unemployment rate, with the market expecting this to come in at 4.2%

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 16/10/17

Notice:

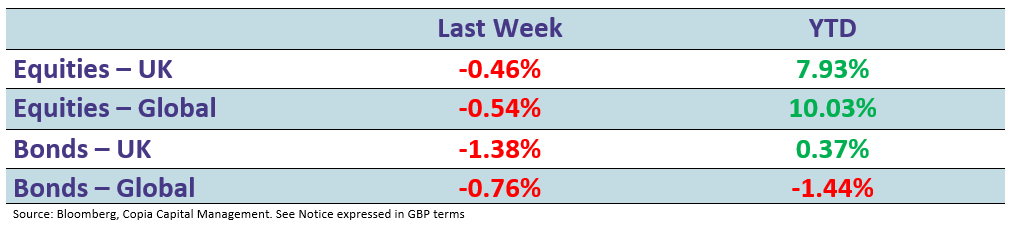

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.