The infoshot to help kick-start your week

AI fears spark selloffs

Fears over AI spending sparked a massive selloff that saw Amazon, Microsoft, Nvidia, Meta, Alphabet and Oracle shares collectively have more than $1tn wiped off their valuations last week.

Amazon’s market capitalisation fell over $300bn after they released their fourth quarter earnings report and announced that their capital expenditure is expected to reach $200bn in 2026, $50bn more than expected. Despite beating revenue expectations, Alphabet shares also fell after they said they expect to spend between $175bn and $185bn in 2026, more than double their 2025 capital expenditure.

Last week, there were also reports that the $100bn September deal between OpenAI and Nvidia might be off. The deal would have seen Nvidia supply OpenAI with money to purchase their own chips. If the deal is off, it could have ramifications for the wider tech and AI sector with OpenAI currently committed to spending around $1.4tn on infrastructure and computational projects. As the cost of AI infrastructure projects mount, there were also reports that Oracle may have to cut 30,000 jobs to help pay for new data centre expansions.

Fears about the impact of AI development on software companies led to a selloff in that part of the market too. The US software sector has now lost more than 30% of its value in the last three months as investors worry that AI tools may make some existing software obsolete.

Gold and silver also had a very turbulent week, falling heavily on Thursday and Friday. They have bounced back a bit this morning. Cryptocurrencies also continued their ongoing decline, with Bitcoin dropping below $70,000 for the first time since November 2024.

Here in the UK, the FTSE 100 remained above 10,000 points following its ascent at the turn of the year and reached a record high on Tuesday. It’s taken a hit this morning as investors weigh-up the political uncertainty caused by Peter Mandelson’s links to Jeffrey Epstein and the resignations of Prime Minister Kier Starmer’s Chief of Staff, Morgan McSweeney and Communications Director, Tim Allan.

Takaichi secures majority in snap election

Japanese stocks surged to a record high today following Sanae Takaichi’s snap election victory on Sunday.

In what was a landslide victory, Takaichi’s Liberal Democratic Party (LDP) won 316 seats, way ahead of the 261 needed for a majority in the lower house. It’s the best post-war election performance in Japan. The LDP and its coalition partner, the Japan Innovation party, now have a two-thirds super-majority making it easier to implement their legislative agenda, and push through a 21tn yen (£99bn) stimulus package.

Markets reacted positively to the news, sending the Nikkei 225 up nearly 4% today. The Nikkei 225 is now up 45% since this time last year.

BoE and ECB keep rates the same

Following their meeting on Wednesday, the Bank of England (BoE)’s Monetary Policy Committee (MPC) decided to keep interest rates at 3.75%.

The BoE vote was divided this time around with only five of the committee members voting in favour. The bank’s Governor, Andrew Bailey, said he “expects to see quite a sharp drop in inflation over coming months” and that due to the risks from inflation appearing to reduce he sees “scope for some further easing of policy.”

The European Central Bank (ECB) also elected to keep rates the same for the fifth consecutive meeting. After the bank cited, “ongoing global trade policy uncertainty and geopolitical tensions”, the ECB President Christine Lagarde said the bank would maintain a “meeting-by-meeting approach” and would not be “precommitting to a particular rate path.”

Coming Up:

- US unemployment rate, Wednesday 11 February 2026

- UK GDP Q4, Thursday 12 February 2026

- Japan GDP Q4, Sunday 15 February 2026

Notice:

For regulated financial advisers and investment professionals only, Copia does not provide financial advice, and the contents of this document should not be taken as such.

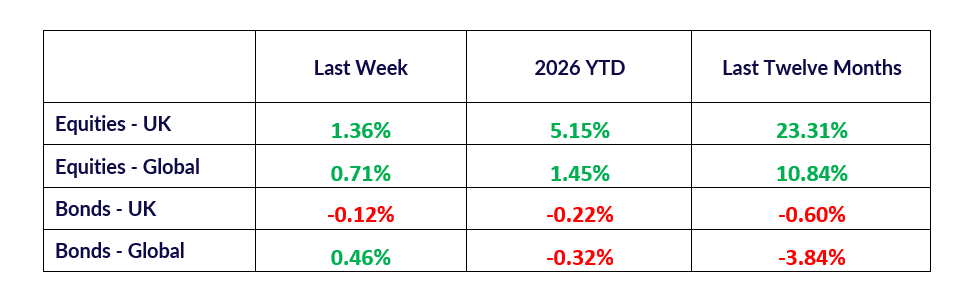

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated but is not an indicator of potential maximum loss for other periods or in the future.