The infoshot to help kick-start your week

Last Week

- In a recent interview, Treasury Secretary Scott Bessent aimed to calm concerns surrounding the Trump administration’s economic direction, particularly amidst Elon Musk’s involvement in streamlining federal spending. Bessent emphasized his alignment with Musk’s “Department of Government Efficiency,” assuring the public that their collaborative efforts are methodical and focused on long-term cost savings for Americans. Downplaying fears about Musk’s team accessing Treasury payment systems, Bessent clarified their access is limited and poses no risk. Overall, Bessent sought to project an image of stability and reassurance, signalling that the administration is deliberately pursuing its economic goals while maintaining a commitment to a strong dollar and fiscal responsibility.

- Amazon is facing challenges in meeting the explosive demand for AI services, mirroring similar issues experienced by Microsoft. Despite planning a massive £80 billion investment in 2025, primarily for data centres and AI-related infrastructure, the company anticipates capacity constraints in its Amazon Web Services (AWS) cloud division. CEO Andy Jassy acknowledged that AWS growth is limited by hardware and electricity supply. While AWS revenue grew 19% in Q4 2024, analysts suggest growth could have been even higher without these constraints. The AI race is expected to impact profits in the short term, with Amazon projecting lower-than-expected operating income for Q1 2025. The company expects constraints to ease in the latter half of 2025.

- Optimism is surging for Chinese tech stocks, particularly those involved in AI, as demonstrated by the Hang Seng Tech Index entering a bull market fuelled by the emergence of DeepSeek, a startup that has developed a low-cost AI model rivalling Western products. This breakthrough highlights China’s growing innovation in the tech sector and has prompted bullish calls from Wall Street brokers citing manufacturing strength and technological competence, with key contributors to the gains including companies like Xiaomi, Li Auto, and Lenovo. The valuation gap between Chinese and other emerging market stocks may narrow as foreign investment increases; however, challenges persist, including US-China tensions and potential restrictions on chip sales, and despite the recent rally, the Hang Seng Tech Index remains significantly below its peak.

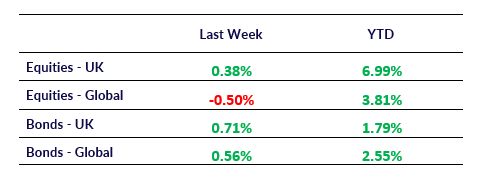

Market Pulse

Coming Up

- UK BoE Gov Bailey Speech, Tuesday 11th February 2025 at 12:15pm

- US CPI Data, Wednesday 12th February 2025 at 1:30pm

- UK GDP Data, Thursday 13th February 2025 at 7:00am

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel