The infoshot to help kick-start your week

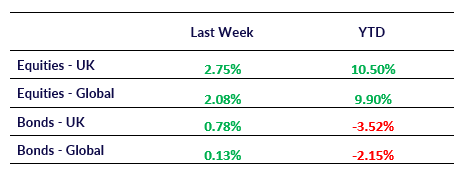

Last Week

- The Bank of England has decided to maintain its interest rates at 5.25% for the sixth consecutive time, but it has hinted at the possibility of a rate cut in June. Andrew Bailey, the Bank’s governor, suggested that a rate reduction next month could be on the table, noting that recent indicators show inflation moving in a favourable direction. He emphasized that the decision for June will be based on upcoming data on inflation, economic activity, and the labour market, but stressed that a rate adjustment in June is neither guaranteed nor dismissed.

- New data from the Office for National Statistics (ONS) reveals that the UK has rebounded from last year’s recession, with the economy expanding at a faster rate than anticipated in March. Monthly growth stood at 0.4%, contributing to a total first-quarter growth of 0.6%. Economists had forecasted a more modest 0.1% growth for March, which would have resulted in a quarterly growth of 0.4% following growth in January and February. These figures mark the end of the recession experienced in the latter half of last year when GDP contracted by a total of 0.4%. Liz McKeown, ONS Director of Economic Statistics, noted that after two quarters of contraction, the UK economy has returned to positive growth in the first three months of this year. She highlighted the robust performance across various service industries, including retail, public transport, haulage, and health.

- Geopolitical tensions concerning China are resurfacing once more. According to sources familiar with the matter, the Biden administration is preparing to implement tariffs on China, possibly as early as next week. These tariffs will target specific industries such as electric vehicles, batteries, and solar cells, while maintaining existing levies. Meanwhile, in Europe, China’s appeal as a prime investment destination is waning, as indicated by a survey showing a significant decline in EU firms’ interest. Additionally, in the UK, Rishi Sunak’s government is under pressure from banks like HSBC and Standard Chartered, as well as other major companies, to ease proposed restrictions on business dealings with China.

Market Pulse

Coming Up

- UK Average Earnings Index + Bonus released, Tuesday 14th May 2024 at 7:00am

- US Federal Reserve Chair Jerome Powell to speak, Tuesday 14th May 2024 at 3:00pm

- US Consumer Price Index (CPI) released, Wednesday 15th May 2024 at 1:30pm

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel