The infoshot to help kick-start your week

Last Week

- The US added 199,000 jobs in November which was both more than expected and above the previous month where 150,000 jobs were added. It was also announced that the unemployment rate slid to 3.7% from 3.9% in the previous month. The data hurt investors’ hopes that the Federal Reserve would be cutting rates in the not-too-distant future and bond prices fell slightly on the back of the news.

- Debt rating agency Moody’s cut the outlook for China’s sovereign credit rating as China struggles to address multiple economic challenges such as the slowdown in the property sector, debt crisis in weak provinces and a broader slowdown of the economy. China’s finance ministry noted its disappointment in the decision but insisted that Country’s long-term prospects remain strong.

- On Thursday, the Yen rose to a three-month high against the dollar after Bank of Japan governor, Kazuo Ueda, suggested that the country may be moving closer to ending its ultra-loose monetary policy. The Yen traded as low as ¥144.6 against the dollar on Thursday but have since risen back to above ¥146.

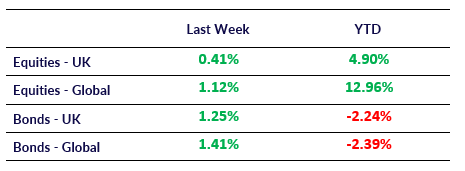

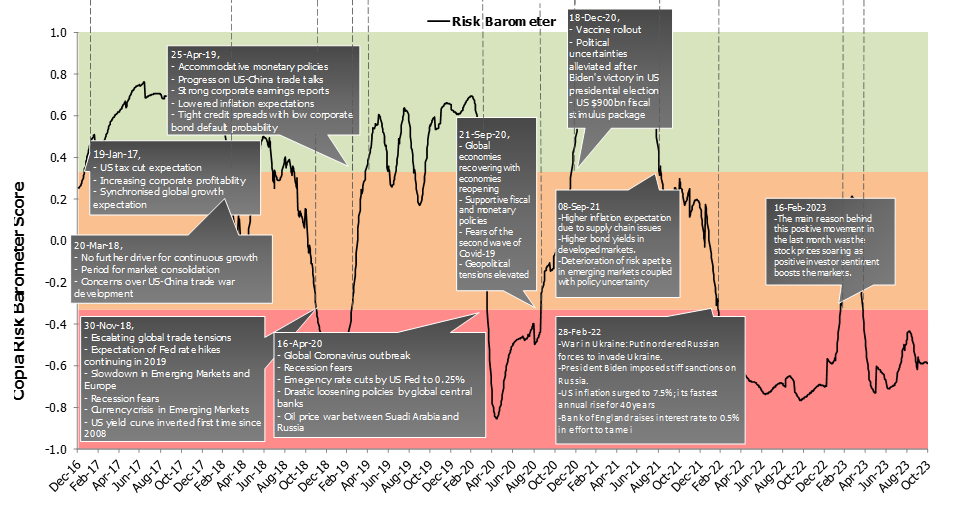

Market Pulse

Coming Up

- US November CPI data released, 12th December 2023 at 1:30pm.

- UK October GDP data released, 13th December at 7:00am.

- UK Bank of England December Interest Rate Decision, 14th December at 12:00pm.

- European Central Bank Interest Rate Decision, 14th December at 1:15pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel