The infoshot to help kick-start your week

Last Week

- The UK Treasury reduced its bond sales target for this year less than expected after a £20bn tax cut was announced by chancellor Jeremy Hunt in the recent Autumn Statement. The Debt Management Office announced gilt issuance would be cut by $500m this fiscal year compared to $15bn expected by 13 banks polled by Reuters. Long-dated gilt yields rose towards the end of last week on the back of the news.

- Investors have been selling off open dollar positions at the fastest rate in a year as they bet that the Federal Reserve has finished its rate cutting campaign. Asset managers are set to cut 1.6 per cent of open dollar positions this month which would make it the largest monthly outflow since November 2022.

- UK business activity grew slightly in November as the S&P Global/CIPS Flash UK PMI index rose to 50.1 from 48.7 in October. The new rate, which is above the benchmark of 50, signals that the majority businesses reported an expansion in output for the first time since July. The results sat ahead of expectations that the index would remain around the 48 mark.

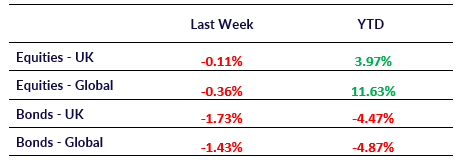

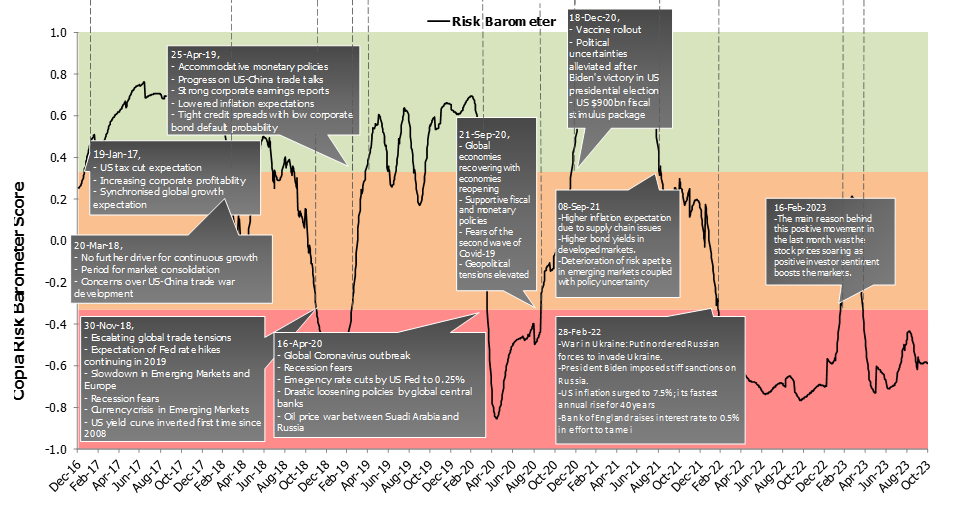

Market Pulse

Coming Up

- US Q3 GDP data released, November 29th at 1:30pm.

- EU November CPI data released, November 30th at 10:00am.

- US initial jobless claims data released, November 30th at 1:30pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel