The infoshot to help kick-start your week

Last Week

- UK inflation remained at 6.7 per cent in September despite being forecasted to fall to 6.6 per cent in the 12 months to September. The slightly higher than expected inflation figure, maintains pressure on the Bank of England and highlights there is still work to be done to bring inflation down to the 2 per cent level. It is suggested that a strong labour market may be contributing to the inflation stickiness as it was announced last week that wage growth outpaced inflation in August.

- Bond markets continued to sell off last week with the 10-year US Treasury yield nearing 5% on Thursday as it hit its highest level since 2007. Treasury yields, which rise when prices fall, have been rising in response to a growing investor belief that US interest rates will stay higher for longer after a series of stronger than expected economic data being released.

- Scotland’s first minister, Humza Yousaf, announced plans for Scotland to issues their first ever government bond to finance infrastructure projects within the country. Under the existing agreement with the UK Treasury, Scotland can raise up to £450m a year but has refrained from doing so in recent years due to likely having to pay a premium above the borrowing costs the UK currently pays through gilt issues.

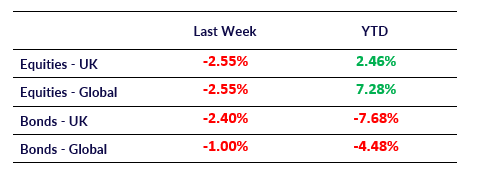

Market Pulse

Coming Up

- ECB Interest Rate Decision, October 26th, 1:15pm.

- US Q3 GDP data released, October 26th, 1:30pm.

- US Initial Jobless Claims data released, October 26th, 1:30pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel