The infoshot to help kick-start your week

Last Week

- Christine Lagarde, the European Central Bank (ECB) president, has highlighted support for the central bank’s current high interest rate at the central bank’s annual conference. Lagarde noted that the ECB had “made significant progress” in stabilising inflation but the fight was far from over with labour markets remaining tight and a large increase in eurozone wages forecasted. This comes after Italy’s government criticised the ECB over concerns that raising rates would put unnecessary pressure on businesses and risk a recession.

- The Nasdaq Composite has recorded its best half year performance since 1999 after gaining 32% since the beginning of the year. This rally has been driven by only a handful of large tech companies such as Nvidia, Apple, Amazon, Tesla, Alphabet, Meta, and Microsoft. Nvidia has led the rally with share prices almost tripling in the last six months. The size of these gains amid a hazy economic outlook has led to several analysts questioning if the returns were sustainable.

- On Friday, Apple saw its valuation close above $3tn as it shares hit a record high on the back of a wider tech rally. Shares have jumped 55% this year despite two back-to-back quarters of declining revenue. The rally has been on the back of Apple’s longer-term prospects as the iPhone captures greater phone market share in emerging markets and the company continues to develop and invest in ambitious and revolutionary products.

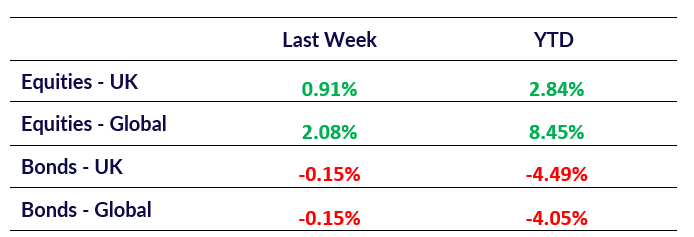

Market Pulse

Coming Up

- Reserve Bank of Australia Interest Rate Decision announced, July 4th, 5:30 am.

- US June Unemployment Rate released, July 7th, 1:30pm

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel