The infoshot to help kick-start your week

Last Week

The US Federal Reserve announced a pause in interest rate hikes after over a year of consecutive rate rises. While the federal funds rate remains at the existing 5%-5.25% target range, the Fed signalled its support for two additional rate rises the help push inflation towards the 2% target. Federal Reserve Chair, Jay Powell, mentioned shortly after the announcement that “Nearly all committee participants view it as likely that some further rate increases will be appropriate this year”.

US banks are set to reach over 11,000 job cuts this year as the industry experiences the worst recruitment market since the financial crisis. Citigroup alone announced last week that it was cutting back 5,000 jobs by the end of the second quarter. These layoffs mark a reversal of the aggressive hiring spree seen by banks in the response to the pandemic, where large workforces were needed to handle a surge in deals and trading.

The US consumer price index (CPI) reached its lowest annual rate in over two years. The index rose only 0.1% during May bringing the 12-month CPI increase down to 4%. Down from 4.9% in April, this 12-month CPI increase is the smallest seen since March 2021 when inflation was beginning to take off. Despite this, 12-month core inflation, which excludes food and energy from the index, still sits at 5.3% and is more reluctant to fall. This indicates that consumers remain under pressure despite a slight easing in

prices.

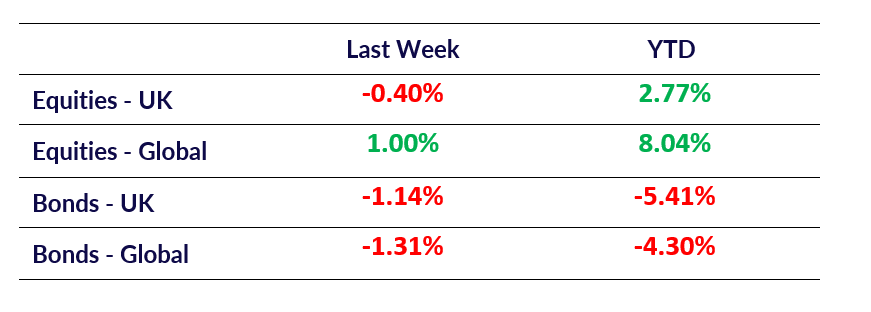

Market Pulse

Coming Up

- UK CPI (YoY May) data released June 21st, 7:00am.

- Fed Chair Powell Economic Outlook Testimony June 21st, 3:00pm.

- BoE Interest Rate Decision released June 22nd, 12:00pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel