The infoshot to help kick-start your week

Last Week

March marks 1 year since the Fed’s first attack on inflation. In retrospect, the 25 basis-point hike to tackle surging prices seems timid, and policymakers soon realised it wasn’t enough, beginning the year-long battle. While CPI has most recently shown a reading of 6.4%, down from the highs of around 9% last summer, there remains a way to go. Fed Chairman Powell insists they are taking “forceful steps” and is scheduled to speak early this week on the subject.

Eurozone inflation fell less than expected last Thursday to 8.5% in the year to February. ECB President Lagarde spoke on the subject, warning that inflationary pressures are likely to remain “sticky in the short term” and commented on the resilience the economy and labour market have been showing. Goldman Sachs said earlier in the week that it was increasing its peak interest rate expectations for the region, adding that a 50 basis-point rise in May is increasingly likely.

UK house prices have seen their biggest annual fall in over 10 years, falling 1.1% in the year to February. The fall can be attributed largely to a rising cost of living, as well as higher mortgage rates. According to Nationwide, this was the first annual fall in property values since November 2012. While mortgage rates have come down following the chaos of Truss’ mini-budget, they remain far above the levels seen in late 2021, making it unlikely for markets to gain momentum in the short term.

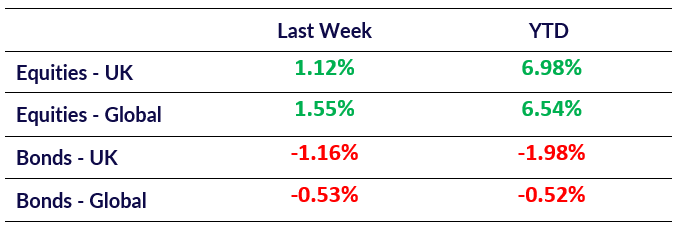

Market Pulse

Coming Up

- UK GDP (MoM Jan) data released March 10th, 7:00 am.

- US Nonfarm Payrolls data released March 10th, 1:30 pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel