The infoshot to help kick-start your week

Last Week

The ECB’s first interest decision of 2023 is days away, but the focus has already shifted to what will happen beyond. After Lagarde and many of her colleagues doubled down on a pledge from December, a 50 basis-point hike is all but guaranteed on Thursday, with the same decision forecasted to follow in March. However, with European energy costs plunging and the Fed considering a slower rate increase on Wednesday, members of the Governing Council are forced to consider a downshift.

Chancellor Jeremy Hunt laid out his Economy growth plan on Friday, referencing the PM’s five pledges and his own ‘four Es’, designed to boost Britain’s post-Brexit economy. As part of this, he has recently been under pressure to cut taxes to stimulate the UK economy. However, he warned that significant tax cuts in the Budget are ‘unlikely’, following periods of record Government borrowing, stating that a pledge to halve inflation is ‘the best tax cut right now’.

Despite higher borrowing costs and a rising cost-of-living dragging on growth, the US economy grew more than expected. The economy grew at an annualised rate of 2.9% in the last 3 months of 2022. While it is down from 3.2% in the previous quarter, it was above the expected 2.6%. While the jobs market remains strong, other parts of the economy are weakening, with home sales, construction and retail sales all taking a hit.

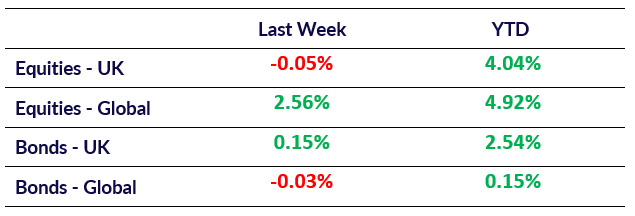

Market Pulse

Coming Up

- Fed Interest Rate Decision released 1st February 7:00 pm.

- BoE Interest Rate Decision released 2nd February 12:00 pm.

- ECB Interest Rate Decision released 2nd February 1:15 pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel