- U.S. nonfarm payrolls increased by just 235,000 across the month of August, well short of the 720,000 new hires projected by economists surveyed by Dow Jones, which may impact the Fed’s decisions to scale back its monetary stimulus programme

- Germany’s national consumer price inflation (CPI) in August accelerated to 3.9% a level not seen since 1993 as the economy recovers from the pandemic and companies struggle with supply shortages

European business activity remains robust in August despite the Delta variant of Covid-19 and continued supply chain disruption. The IHS Markit composite PMI dropped to 59.0 in July’s 15-year high of 60.2, remaining clear of the 50 mark which separates expansion from contraction

Recovery to global trade is beginning to wane after early warnings pointing to the downsides of widespread Covid-19 in manufacturing centres of east Asia such as Taiwan, and port closures in Australia, China, and Japan. The outlook for export orders for the next 3 months has fallen from 70% year-on-year growth in 2020 to just 20%

European Employment and GDP data for Q2 to be released on Tuesday 7th September

UK House Price Index data to be released on Tuesday 7th September

COPIA’S RISK BAROMETER

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/08/21

Notice:

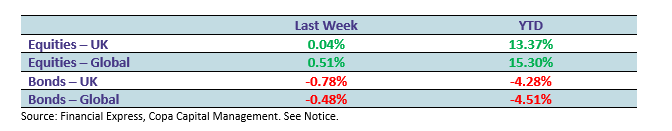

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.