![]() China has ordered state owned enterprises to limit their exposure to overseas commodities markets to combat speculation. Chinese authorities also announced they will also release stockpiles of zinc, copper and aluminium from national stockpiles, resulting in a drop in metals prices in London and Shanghai.

China has ordered state owned enterprises to limit their exposure to overseas commodities markets to combat speculation. Chinese authorities also announced they will also release stockpiles of zinc, copper and aluminium from national stockpiles, resulting in a drop in metals prices in London and Shanghai.

![]() UK inflation rose 2.1% from a year earlier in May beating the expected 1.8%. One of the main drivers of this being energy prices with oil trading above $72 a barrel.

UK inflation rose 2.1% from a year earlier in May beating the expected 1.8%. One of the main drivers of this being energy prices with oil trading above $72 a barrel.

![]() The US Treasury yield curve has seen its largest two day tightening since March of last year with 30-year yields dropping to 2.07% with investors pulling back their inflation bets following Fed insistence that inflation will be transitory.

The US Treasury yield curve has seen its largest two day tightening since March of last year with 30-year yields dropping to 2.07% with investors pulling back their inflation bets following Fed insistence that inflation will be transitory.

![]() Eurozone inflation figures released Thursday June 17 showed a 2% YoY increase as was widely expected. The ECB continues to remain dovish on rates in light of this data.

Eurozone inflation figures released Thursday June 17 showed a 2% YoY increase as was widely expected. The ECB continues to remain dovish on rates in light of this data.

![]() Bank of England interest rate decision to be announced Thursday June 24.

Bank of England interest rate decision to be announced Thursday June 24.

![]() Japanese CPI data to be released on Tuesday June 22. Expected -0.10% YoY.

Japanese CPI data to be released on Tuesday June 22. Expected -0.10% YoY.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/05/21

Notice:

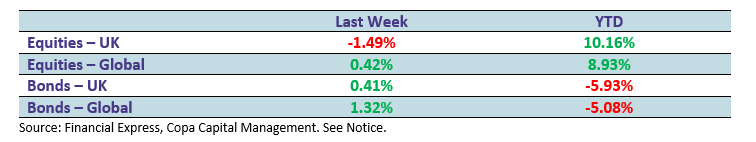

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.